In this guide, we will delve into the world of investment banking. We’ll be exploring what these institutions do, their inner workings and hierarchical structure, job opportunities in this field, as well as salary expectations.

Highly Rated Stock Trading & Investing Platform

-

Invest in stocks, ETFs, options and crypto

-

Copy top-performing crypto-traders in real time, automatically.

-

0% commission on buying stocks - buy in bulk or just a fraction from as little as $10. Other fees apply. For more information, visit etoro.com/trading/fees.

-

eToro USA is registered with FINRA for securities trading.

What is investment banking?

The field offers roles ranging from consultants and analysts to research associates and trading specialists – each requiring its own unique educational qualifications and skill set.

Currently, the biggest investment banks in the U.S. are JPMorgan (NYSE: JPM), Goldman Sachs (NYSE: GS), Citigroup (NYSE: C), and Morgan Stanley (NYSE: MS). Not far behind them is a formidable group of international banking giants, such as Deutsche Bank, Barclays, Credit Suisse, and UBS.

Investment bank vs commercial bank

Commercial banks and investment banks are both essential components of a modern economy; however, their respective functions vary widely. Commercial banks are what we think of when we picture a bank and provide an array of banking services, from accepting deposits to issuing loans and safeguarding assets. They work with numerous clients, including the general public and businesses.

In contrast, investment banks offer services to major corporations and institutional investors and may help in merger and acquisition transactions, issue securities, or provide financing for large-scale business projects.

Recommended video: Investment banking explained

Investing for beginners:

- What is Investing? Putting Money to Work

- 17 Common Investing Mistakes to Avoid

- 15 Top-Rated Investment Books of All Time

- How to Buy Stocks? Complete Beginner’s Guide

- 10 Best Stock Trading Books for Beginners

- 15 Highest-Rated Crypto Books for Beginners

- 6 Basic Rules of Investing

- Dividend Investing for Beginners

- Top 6 Real Estate Investing Books for Beginners

Highly Rated Stock Trading & Investing Platform

-

Invest in stocks, ETFs, options and crypto

-

Copy top-performing crypto-traders in real time, automatically.

-

0% commission on buying stocks - buy in bulk or just a fraction from as little as $10. Other fees apply. For more information, visit etoro.com/trading/fees.

-

eToro USA is registered with FINRA for securities trading.

What do investment banks do?

Investment banks are known for their role as middlemen between corporations and investors. With their expertise, they can offer a wide range of services, including:

- Raise equity capital/IPO issuance: Investment banks are invaluable in assisting firms in raising capital through equity financing. In short, they facilitate the sale of ownership (or equity) within a corporation, thus securing necessary funds for the business. This is typically done through IPOs, where a private company transitions to public ownership by becoming listed on an exchange. They work closely with the issuing body to put together a prospectus for potential investors, determine the initial offering price, take care of the marketing and documentation, as well as the distribution of shares;

- Underwriting: Investment banks mitigate much of the risk associated with IPOs by purchasing the shares outright from issuers and selling them to public or institutional buyers;

- Raise debt capital: Investment banks also help governments and companies raise capital through debt financing, typically by issuing and underwriting bonds for the company (as well as pricing and acquiring credit ratings for those bonds). Ultimately, by purchasing bonds, investors essentially lend the company money and provide the necessary capital.

- Provide strategic advice: By offering strategic advice on a broad array of financial matters, an investment bank acts as a trusted advisor to major institutional investors;

- Facilitate mergers and acquisitions (M&A): The investment bank assesses a potential acquisition’s value and negotiates a fair price. Additionally, it provides a framework for facilitating the acquisition process and ensures that everything runs as smoothly as possible;

- Research: Investment banking firms maintain research departments that study companies and craft reports about their future outlook, often with buy, hold, or sell ratings. This research may not bring in immediate profits, yet it aids an investment bank’s internal traders and sales department while also offering clients comprehensive financial analysis and expert advice;

- Asset management: Investment banks provide expert advice and management of investments for a variety of clients across a wide range of investment styles– from large institutional investors to individuals with more modest portfolios;

- Proprietary trading: An internal team of money managers makes investments and trades using the company’s own money for its private account.

How do investment banks work?

All investment banking activity is split into two divisions: the buy side and the sell side. Larger service investment banks generally offer both the buy and sell side, whereas regional boutique banks might only specialize in a particular area, such as mergers and acquisitions.

The buy side typically works with pension funds, hedge funds, mutual funds, and everyday investors to help them maximize their profits when investing in various asset classes. The selling arm of the bank, on the other hand, is involved with launching IPOs, placing bond issues, partaking in market-making services, as well as assisting clients in transactions.

Investment banking activities are further divided into three distinct divisions based on the different services provided and employees’ responsibilities:

- Front office: The front office is the vital division responsible for driving corporate profits, staffed with corporate finance and sales professionals;

- Middle office: The middle office sits between the front and back office and is responsible for risk management, as well as for the firm’s information technology. They may also evaluate the legal compliance of a transaction and ensure the transaction aligns with agreements;

- Back office: The back office is responsible for various operational concerns, mostly related to administrative tasks and clerical work, and some back offices also provide technical support (e.g., creating new trading algorithms).

How to become a banker?

A Bachelor’s degree in a finance-related area is typically required to begin your journey as an investment banker. However, you’ll find countless ways to develop and hone your skills through on-the-job training as well as supplemental certifications. Below, we have outlined the standard step-by-step course for becoming an investment banker and scoring one of the best-paying jobs in finance.

1. Earn a Bachelor’s degree

Generally, a Bachelor’s degree is the minimum required educational qualification to work as an investment banker, with candidates with degrees in finance, accounting, business administration, or related fields usually favored. However, certain investment banks might still require a Master’s degree for entry-level positions.

2. Gaining experience

For many aspiring investment bankers, their career journey begins with internships at various banking institutions during their undergraduate studies. Though not a requirement, an internship with a top firm can be instrumental in helping someone get their foot in the door. Additionally, internships offer invaluable on-the-job experience, which is essential for success.

Highly Rated Stock Trading & Investing Platform

-

Invest in stocks, ETFs, options and crypto

-

Copy top-performing crypto-traders in real time, automatically.

-

0% commission on buying stocks - buy in bulk or just a fraction from as little as $10. Other fees apply. For more information, visit etoro.com/trading/fees.

-

eToro USA is registered with FINRA for securities trading.

3. Obtain professional certifications

Investment bankers must obtain professional certifications from the Financial Industry Regulatory Authority (FINRA). This is typically completed after getting hired, as the licensing process requires sponsorship from an employing firm. Investment banks often demand Series 63 and 79 licenses, although the specific requirements may differ depending on their role.

You can also pursue optional certifications, such as the Chartered Financial Analyst (CFA) certification, which involves completing the CFA program and passing an exam.

4. On-the-job training

As an entry-level applicant, you will usually begin as an analyst and become fully prepared through a special training program your employer provides prior to taking on the job. Goldman Sachs, for instance, has Goldman Sachs University, which provides education to new analysts for 6-8 weeks.

Depending on the financial institution, this training offers an in-depth exploration of accounting practices, markets, risk assessment, financial analysis, statement analysis, and financial modeling. A junior analyst can expect to spend about two years in the on-the-job training phase.

Through on-the-job training, you’ll have a chance to sharpen your negotiation, presentation, and communication abilities. Moreover, employers regularly provide ongoing educational and professional development opportunities for entry-level investment bankers to encourage career progression. For those junior bankers who exceed expectations, there is ample opportunity for advancement into a senior role and the ability to oversee all aspects of transactions from inception to completion.

5. Advancing your career

You can advance your career in various ways once you start working as an investment banker. For example, suppose you decide to pursue investment banking with a Bachelor’s degree. In that case, your employer may assist you by aiding further education, certifications, or even training for the first few years of work.

With the proper experience, you can apply for higher-level roles and gain more responsibility. For example, an entry-level investment banker can progress up the management ranks, such as vice president or director, where they will manage other analysts and associates beneath them.

Investment banker qualities

Working in finance can be incredibly rewarding and exciting, as well as nerve-wracking, high-pressured, and demanding. As a result, investment firms typically have stringent criteria when hiring employees, given the combination of mental and emotional aspects necessary in these jobs. To become a banker and thrive in a career as an investment banker, one must possess the following skills:

- Intellect: The essential qualification for this role. A powerful intellect, especially one focusing on analytics, mathematics, finances, and economics, is a must to perform on the job efficiently. Additionally, investment banking necessitates a curious mind, prompting you to explore and comprehend not only your own projects but also how they intertwine with those of your colleagues;

- Self-discipline: Investment bankers, regardless of the role they fill within the industry, from entry-level analyst to managing director, work in a high-stress environment and must remain composed while operating under immense pressure. Many of these qualities are innate but can also be achieved through various rigorous undertakings such as graduating from law or medical school or athletic feats like competing on a collegiate sports team. With drive, determination, and perseverance, most people can learn how to develop these traits throughout life;

- Cultural competence: In today’s interconnected world, having an open-minded attitude and understanding different cultures and societies are essential for doing business on a global level. Combining that knowledge with an ability to communicate in more than one language is an invaluable asset in investment banking. Therefore, as you pursue a college education, take the opportunity to further enrich your experience by learning a new language or studying abroad;

- Relationship-building: The ability to deal with demanding clients in stressful situations, maintain a positive attitude and develop and support client relationships are characteristics that investment bankers must possess to succeed. After all, investment bankers make money based on the fees they receive from their clients, so it is paramount to have excellent interpersonal skills not only to acquire new customers but also to retain long-term ones;

- Creativity: While investment banking is often seen as a field requiring strict adherence to rules and regulations, creativity and inventive thinking are also highly valued skills. The ability to “think outside the box” might serve as the most potent trait for finding new innovative solutions, and while academics may reinforce it, it is often instinctive.

Career progression in investment banking

The career progression for investment bankers is as follows:

- Analyst;

- Associate;

- Vice President;

- Director;

- Managing director.

Generally, undergraduates are recruited straight from university into a two-year analyst training scheme. If they successfully survive the first two years, they will be asked to complete the third year. The top-performing analysts are then rewarded with a promotion to an associate-level position.

To go straight into an associate role with an investment bank, you must possess either an MBA or be in the process of obtaining one.

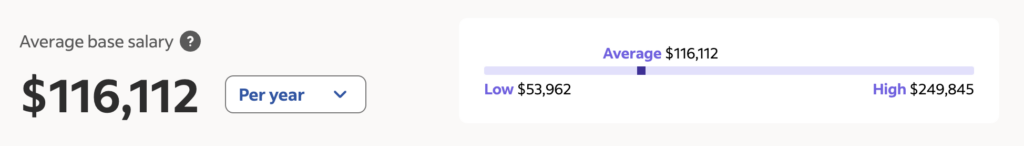

Investment banker salary explained

The salary of most investment bankers contains five components:

- Base salary: This is what you earn through your paycheck regardless of performance. Mid-to-large banks will be in the range of $85-95k for 1st, 2nd, and 3rd-year analysts. Associates will make $140-180k as they move up the ladder;

- End-of-year bonus: Your end-of-year compensation will be based on your performance, deal flow, and industry experience; this reward generally falls within the 70-100% range of your base salary;

- Stub bonus: Those hired in the middle of the calendar year are entitled to a starter bonus equal to 20-30% of their first-year base salary over the initial six months on board;

- Signing bonus: Analysts and associates who accept full-time roles after graduating can expect a signing bonus of between $10,000 – $15,000 for analysts and up to $50,000 -$60,00 for associates;

- Employee benefits: Generous 401(k) plans, health insurance, and vacation days.

Highly Rated Stock Trading & Investing Platform

-

Invest in stocks, ETFs, options and crypto

-

Copy top-performing crypto-traders in real time, automatically.

-

0% commission on buying stocks - buy in bulk or just a fraction from as little as $10. Other fees apply. For more information, visit etoro.com/trading/fees.

-

eToro USA is registered with FINRA for securities trading.

Investment banker salary – how much do they make?

Investment banking is one of the few careers where graduates can expect to make six figures. For example, the the average annual base salary in the US for investment bankers is of $116k.

The estimated additional compensation is $9k-$16k annually, typically including a signing bonus, end-of-year bonus, and commissions. The “most likely range” represents the values within the 25th and 75th percentile of all salary data available for this role.

Senior investment bankers can make an astronomical amount of money annually, frequently reaching into the tens of millions. However, getting to the top of this field is an intricate, multi-stage journey that necessitates a combination of education, ambition, long hours, skill, experience, and connections, not to mention a bit of luck.

Top investment banks in the world

We’ve listed some of the top investment banks in the world below. These are the largest, most reputable, and most profitable investment banks that offer a wide range of financial solutions, including investment banking, mergers and acquisitions, risk management, and capital raising, as well as solutions for corporations, institutions and governments.

As of July 2023, JPMorgan held the top spot in global investment banking with an 8.5% market share of the total revenue, ahead of Goldman Sachs, which captured a 6.7% market share.

Indeed, JPMorgan Chase and Goldman Sachs also led in terms of revenues. Other key players in this sector included Morgan Stanley, Bank of America, and Citibank, each contributing significantly to the industry’s financial landscape.

Some of the top investment banks in the world include:

1. JPMorgan Chase

JPMorgan Chase & Co. (NYSE: JPM) is one of the world’s largest investment banks providing a range of financial services to individuals, businesses, and institutions. The company was formed in December 2000 after the merger of J.P. Morgan & Co. and Chase Manhattan Corporation. The investment bank is headquartered in New York City, led by Chairman and CEO Jamie Dimon. As of the end of 2023, JPMorgan Chase had total assets of over $4 trillion, generating over $154 billion in revenue.

JPMorgan Chase offers various services, including personal banking through its subsidiary Chase Bank, credit cards, investment banking, asset management, wealth management, and commercial banking. It operates in over 60 countries and has more than 240,000 employees worldwide.

2. Goldman Sachs

Goldman Sachs Group (NYSE: GS) is a global investment banking, securities, and investment management firm founded in 1869 and headquartered in New York City. Goldman Sachs provides financial services to corporations, financial institutions, governments, and high-net-worth individuals.

Goldman Sachs has a reputation for being one of the world’s most prestigious and influential investment banks that has been involved in many high-profile transactions. Goldman Sachs operates in three main segments: Investment Banking, Global Markets, and Asset Management.

3. BofA Securities (previously Bank of America Merrill Lynch)

BofA Securities was previously known as Bank of America Merrill Lynch (BAML) before it was changed in 2019. BofA Securities is the investment banking division of Bank of America (NYSE: BAC), one of the largest financial institutions in the United States. It provides various financial services to corporations, financial institutions, governments, and high-net-worth individuals.

4. Morgan Stanley

Morgan Stanley (NYSE: MS) is a US-founded global investment bank and financial services firm. It was set up in 1935 in New York, US, and is also headquartered in New York City. Morgan Stanley provides a range of financial services to corporations, governments, institutions, and individuals around the world. Morgan Stanley operates in three main segments: Institutional Securities, Wealth Management, and Investment Management.

5. Citigroup

Citigroup (NYSE: C) is a global financial services company headquartered in New York City. It was formed in 1998 through the merger of Citicorp and Travelers Group, with a presence in over 160 countries.

Citigroup offers a wide range of financial services, including investment banking, retail banking, credit cards, and wealth management, operating through two primary business segments: Global Consumer Banking –Citibank (retail banking services, including deposits and lending) and Institutional Clients Group (investment banking and trading services, including advisory services, securities trading).

6. Barclays

Barclays (NYSE: BCS) is a global financial services company headquartered in London, with a long history dating back to 1690. It has a strong reputation for innovation in the UK’s financial industry. Barclays bank provides a wide range of financial services to corporate and individual clients in more than 40 countries and operates through two main divisions: Barclays UK and Barclays International.

Barclays UK provides retail banking services to customers in the UK, including deposit-taking, lending, and insurance. Barclays Corporate & Investment Bank branch provides international investment banking services worldwide, including wealth management and investment products to both institutional and individual investors.

7. Credit Suisse

Credit Suisse Group (NYSE: CS) is a global financial services company headquartered in Zurich, Switzerland, with a long history dating back to 1856. Credit Suisse has a good reputation for its expertise in private banking and wealth management.

The Swiss bank provides a wide range of financial services to corporate and individual clients around the world. Credit Suisse operates through four divisions: Wealth Management, Investment Bank, Swiss Bank, and Asset Management, in four regions: Switzerland, EMEA, APAC, and Americas.

In March 2023, UBS agreed to buy Credit Suisse for $3.25 billion after talks with the Swiss government to prevent Credit Suisse’s financial downfall. The deal was finalized in June 2023.

8. Deutsche Bank

Deutsche Bank (NYSE: DB) is a global financial services company headquartered in Frankfurt, Germany. Germany-based Deutsche Bank has a long history dating back to 1870 and has a strong reputation for its investment banking and trading expertise. It provides various financial services to corporate and individual clients worldwide.

Deutsche Bank operates through four main divisions: Corporate Bank (financial solutions targeted to corporate clients), Investment Bank (advisory, mergers and acquisitions, trading), Private Bank (personal banking solutions), and Asset Management (DWS).

9. Jefferies LLC

Jefferies LLC is a global investment bank founded in 1962 and headquartered in New York City. It provides many different financial services to corporate and individual clients worldwide, including investment banking, sales, trading, research, and wealth management.

Jefferies is widely regarded as a leading independent investment bank, meaning it is not part of a larger commercial or retail bank. It operates through several divisions: Investment Banking, Equities, Fixed Income, Asset Management, and Wealth Management.

10. RBC Capital Markets

RBC Capital Markets (NYSE: RY) is an investment bank division of the Canadian divisions of Royal Bank of Canada (RBC), one of the largest banks in Canada, founded in 1864 in Halifax Regional Municipality. The bank has a good reputation both in Canada and globally.

The RBC Capital Markets divisions provide a range of financial services to corporate and institutional clients worldwide, including advisory services for mergers and acquisitions, underwriting for securities offerings, and trading of various financial instruments.

11. HSBC

HSBC (Hongkong and Shanghai Banking Corporation) (NYSE: HSBC) is a global banking and financial services company founded in Hong Kong in 1865, now headquartered in London, UK. As a global bank, HSBC provides financial services to corporate and individual clients in more than 62 countries. HSBC is split into main business groups: Commercial Banking, Global Banking and Markets, and Wealth and Personal Banking.

12. Wells Fargo Securities

Wells Fargo Securities is the investment banking and capital markets division of Wells Fargo (NYSE: WFC), one of the largest banks in the United States, founded in 1852. The bank has corporate headquarters in San Francisco, California, and operational headquarters in Manhattan.

Wells Fargo Securities provides financial services to corporate and institutional clients, including investment banking, capital markets, and trading. The bank’s main divisions include personal, wealth management, commercial banking, and corporate & investment banking. Despite the excellent reputation, the bank faced significant challenges in the past, including a scandal about opening bank accounts for customers without their authorization.

In conclusion

The common misconception is that anyone good with numbers will excel at a career as an investment banker. Yet, the best investment bankers, along with being math whizzes, also have exceptional communication and negotiation skills, a sharp intellect that allows them to think on their feet, and an unwavering work ethic– abilities that no equation can quantify. So, if you dream of a lavish lifestyle with fancy cars and exotic getaways, you must be ready to face the long hours that facilitate that opulence.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

FAQs about investment banking

What is investment banking?

Investment banking is a financial service that assists businesses, governments, and organizations with raising capital. Investment banking activities encompass services such as IPO underwriting, facilitating mergers and acquisitions, reorganizations, and providing brokerage services to institutions or individual investors.

What's the difference between an investment bank vs commercial bank?

Investment banks and commercial banks are both financial institutions that provide services to individuals, businesses, and governments. The primary difference between the two is that investment banks specialize in underwriting and distributing securities, while commercial banks focus on providing deposit and lending services.

What are the big 4 investment banks?

The big four investment banks are JPMorgan, Goldman Sachs, Citigroup, and Morgan Stanley.

Who are the clients of investment banks?

Clients of investment banks include private and public companies, pension funds, other financial institutions, governments, and hedge funds.

How to become a banker?

To become a banker, a college degree in finance, economics, or a related field from a reputable university is virtually a prerequisite. In addition, an MBA, an advanced degree in math, or a Chartered Financial Analyst (CFA) certification can drastically bolster your prospects as a candidate.

What is an investment banker salary?

Entry-level employees can expect six-figure salaries, while senior investment bankers in the prime of their careers can be awarded yearly earnings reaching tens of millions.

What was the role of investment banks in the Great Recession?

Investment banks played a significant role in the Great Recession. They were responsible for creating and selling complex financial products (often to investors unaware of the risks associated with them), such as mortgage-backed securities (MBSs) and collateralized debt obligations (CDOs) based on subprime mortgages and loans with a high likelihood of default. When the housing market crashed, these investments became worthless, leading to massive losses for investors and banks alike. This, in turn, caused a liquidity crisis, leading to many financial institutions’ collapse and the Great Recession.

What are some entry level investment banking jobs?

Entry-level investment banking jobs include positions such as Investment Banking Analyst, where you’re responsible for financial analysis and modeling; Equity Research Analyst, focusing on stock market analysis; and Sales and Trading Analyst, dealing with buying and selling securities. Other roles include Operations Analyst, working on the bank’s internal processes, and Compliance Analyst, ensuring adherence to regulations.

Highly Rated Stock Trading & Investing Platform

-

Invest in stocks, ETFs, options and crypto

-

Copy top-performing crypto-traders in real time, automatically.

-

0% commission on buying stocks - buy in bulk or just a fraction from as little as $10. Other fees apply. For more information, visit etoro.com/trading/fees.

-

eToro USA is registered with FINRA for securities trading.