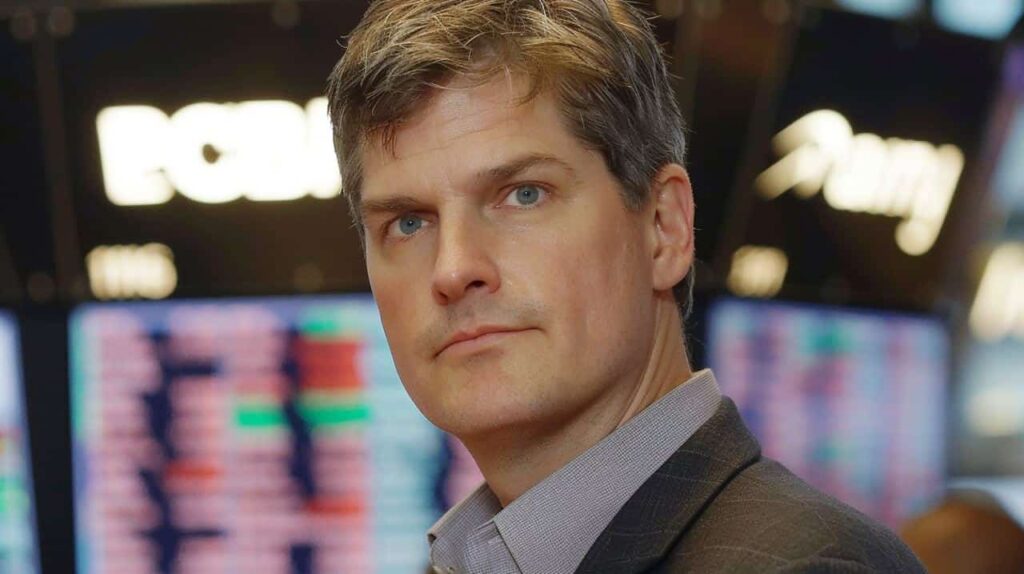

Michael Burry’s stock market activities have been a major point of interest for investors ever since he made it big with a well-placed bet ahead of the 2008 crisis, which has since solidified its place in history as “The Big Short.”

More than a decade and a half later, Burry is still making intriguing choices with his portfolio.

The Q3 2023 $4 million Alibaba (NYSE: BABA) bet, for example, has taken much attention in recent months, mostly due to the Chinese company’s seemingly endless decline following the purchase.

Picks for you

Still, “The Big Short” investor Michael Burry is far from invested only in Alibaba – and Alibaba itself has recently been doing better – so Finbold decided to take a look at some of his top stock holdings and how they have been performing since the start of 2024.

Alibaba (NYSE: BABA)

According to the most recent available filings, Alibaba remains the biggest individual holding in Michel Burry’s portfolio – albeit with a small margin – and has, so far, mostly been losing money for the Big Short investor.

Indeed, when Burry made his $4 million BABA bet in the third quarter of 2023, the company’s shares were worth approximately $86, while their latest close placed them at $76.06.

Despite still being below the purchase price, 2024 has offered some silver lining for Burry and Alibaba stock alike.

The company has been on a highly volatile path of recovery after the Chinese government stepped in to stabilize its markets after what appeared as a multi-year crisis turned into a money abyss in January and early February.

Year-to-date (YTD), Alibaba shares are 1.74% in the green and the more recent performance is decidedly more positive. The last 30 days saw the stock rise 6.23%, and the last 7 saw it increase in value by 2.51%.

At the latest close on Tuesday, March 12, Alibaba shares were 1.20% in the green and are $3 above their price when Finbold made its latest assessment of Burry’s investment at $76.06.

JD.com Inc. (NASDAQ: JD)

Michael Burry’s second-largest holding at the time of publication is another Chinese company: the e-commerce platform JD.com Inc. (NASDAQ: JD).

Through much of early 2024, JD stock has been following a similar pattern to many of its peers in the Chinese market. The e-commerce shares started the year in what looked like a freefall, only to stabilize after the government promised to step in with a massive financial injection.

More recently, the JD shares started decisively rising with the most dramatic climb taking place in early March as the company published a strong Q4 earnings report.

YTD, JD is only 0.63% up, but its performance in the last 30 days – bringing a 23.68% rise – and the last 7 days – with a 10.19% surge – present a strong case that Burry’s investment might pay off significantly in the coming months.

The most recent close has also been positive for JD stock as it ended the day 4.99% in the green at $27.37.

HCA Healthcare (NYSE: HCA)

“The Big Short” Michael Burry’s third-largest holding is located on the other side of the Paicific – HCA Healthcare (NYSE: HCA). The American healthcare stock is a relative newcomer to the portfolio as it was acquired sometime in the fourth quarter of 2024 and has provided a far less checkered performance than Alibaba and JD.

Indeed, as it is likely that Burry acquired HCA stock near the time it took a major hit after publishing its Q3 report, it has done little other than rise since it found its place among the famous investor’s holdings.

YTD, HCA shares are 17.52% in the green. The story is much the same in other timeframes and the stock is also up in the last 30 days – 6.24% – 7 days – 1.81% – and 24 hours – 0.72%.

At the latest close on Tuesday, March 12, HCA shares were worth $323.55.

Oracle Corporation (NYSE: ORCL)

Michael Burry’s fourth-largest holding has been, hands down, his best-performing major investment in the first trimester of 2024.

While generally staying in the green since January 1, Oracle Corporation (NYSE: ORCL) has also offered a staggering 1-day surge on March 12 after publishing its latest earnings report.

The standout data point from the document that helped the company close 11.75% in the green at $127.54 is that its cloud revenue jumped a stunning 25% in the quarter.

Oracle stock has also been performing well for a long time. YTD, the company is 22.56% in the green, and it also rose 12.19% in the last 30 days – though, admittedly, the entirety of the growth in the time frame is accounted for by the one-day jump in the wake of the earnings report.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.