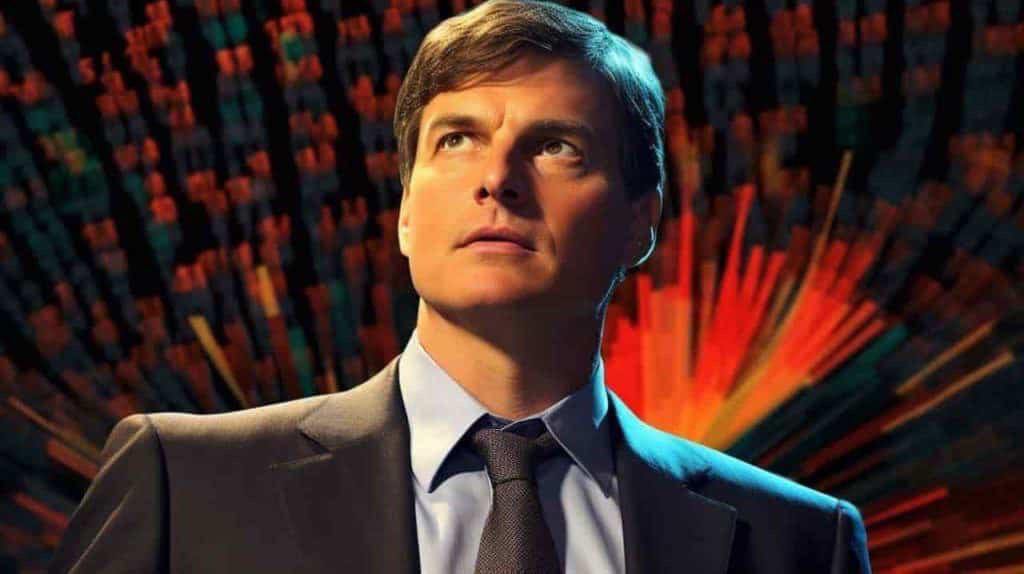

Though Michael Burry is best known for ‘The Big Short’ during the Great Recession, his most controversial investment is at the time of publication and has been for more than a year the bet on the Chinese e-commerce and technology giant Alibaba (NYSE: BABA).

Indeed, Burry’s investment in BABA has been closely watched since it was first made in the third quarter of 2023, thanks to both being one of his largest positions – second only to JD.com (NASDAQ: JD) in the latest available full portfolio update – and to seemingly perpetually staying at the edge of profitability.

‘The Big Short’ investor, looking at the prices Alibaba shares were trading at the time the original 50,000 were purchased, spent some $4.3 million acquiring the stock and, since the shares are, at press time, worth $81.25 – approximately $5 less than Q3, 2023 – Burry is about $300,000 down on the bet.

Still, the famous trader has been continuously purchasing BABA stock over the previous 12 months, and since the Chinese giant has been trading with substantial volatility in the time frame, it is likely he is either neutral or even slightly in the green on the 125,000 shares he held at the time of the most recent 13-f.

Is Burry’s BABA bet set to turn green?

Despite the lackluster performance of the investment, BABA stock’s recent performance hints that ‘The Big Short’ investor may soon be in the green on the bet. Since stock market trading first opened in 2024, Alibaba rose 8.67%.

Though the previous major rally – a rally that possibly sent the totality of Burry’s investment into the green as BABA shares crossed above $88 – quickly corrected down toward $80, technical analysis of the stock’s performance in the last 7 days indicates upcoming trading may be substantially more positive.

Overall, Alibaba shares are rated as ‘buy’ on TradingView with both oscillators and moving averages (MA) offering said reading. Still, technical analysis based on only the last 30 days highlights the uncertainty that has permeated BABA’s performance in the last 52 weeks, with the overall rating flipping to ‘sell.’

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.