The meme-stock frenzy appears to reign after Roaring Kitty, a significant figure in previous GameStop (NYSE: GME) stock surges, shared a screenshot on Reddit suggesting a substantial investment in the gaming retailer.

This news is important for GME stock and AMC shares, as they participated in the initial short squeeze in 2021 and benefited substantially from the latest meme-stock frenzy in May.

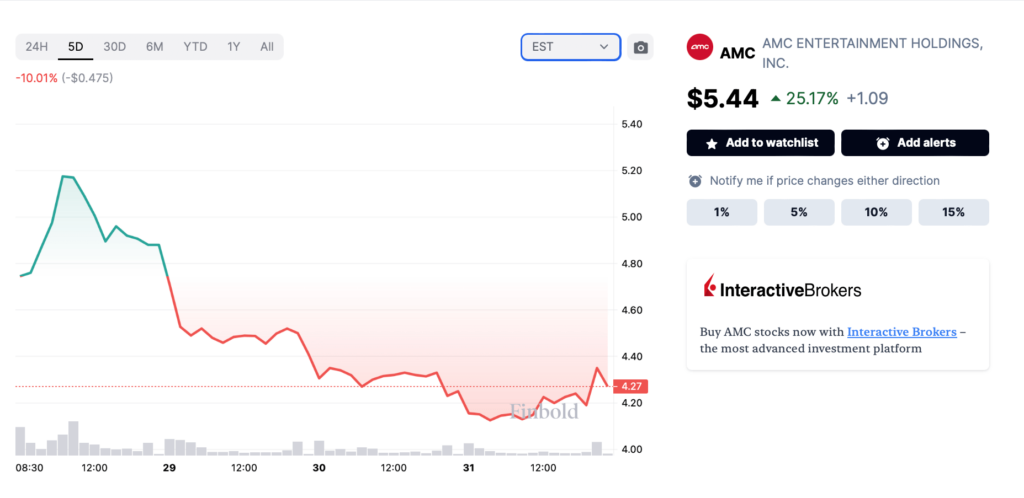

Despite Roaring Kitty’s post not mentioning AMC Entertainment (NYSE: AMC), AMC stock has also rallied strongly, rising 25% in premarket trading to reach $5.44 at the time of writing.

Roaring Kitty previously fueled a meme-stock rally in mid-May, where AMC shares reached a $9 valuation, and stocks that surged then also saw gains in Monday’s premarket trading.

AMC financials might hint at recovery

AMC Entertainment recently released its first-quarter report, revealing positive results. Revenues exceeded analyst expectations by 4%, reaching $951 million. This boost in revenue also resulted in smaller-than-expected statutory losses, which were $0.62 per share, 4% less than anticipated.

With a better-than-expected earnings report and the recent surge in AMC share price, Finbold analyzed whether AMC stock is a buy.

AMC stock faces significant challenges

Post-pandemic, AMC has struggled to return to pre-pandemic sales levels, as many people have grown accustomed to alternative forms of entertainment they discovered during lockdowns, reducing theater attendance and box office revenue.

Additionally, as of late 2023, AMC had a substantial debt load of $4.5 billion, which hampers its ability to seize new opportunities and manage operations effectively.

Operating costs are also a significant concern, with over 30,000 employees needing to manage 10,000 screens, utility bills, cost of goods sold, and movie rights expenses.

Technical analysis of AMC stock

The technical indicators for AMC shares suggest a mixed outlook with conflicting signals between moving averages and MACD. The RSI is in neutral territory, and stochastic indicators show a bearish trend.

Current gains are not enough, according to stock expert Antonio Costa, who highlights the need for AMC shares to rise above the $6 threshold and sustain these gains through several trading sessions.

The combination of conflicting trends, momentum signals, and volume suggest a potential short-term upward movement in the stock price before reversal, warranting caution for traders and investors.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.