GameStop (NYSE: GME) shares took a big hit in premarket trading on May 16, dropping further after already experiencing significant losses the day before. This suggests that the frenzy around the meme stock might be losing steam.

The traditional video game retailer saw its stock fall by almost 16% in premarket. This comes after the company had already seen steep declines of 19% respectively in the previous day.

Just earlier this week, GameStop had experienced huge spikes in its stock price, with GME shares shooting up by 179% over three days.

Dwindling interest from investors in GME stock

GME shares had seen a surge in trading activity and stock price at the beginning of the week, but it seems that interest from individual investors has dwindled rapidly this time around.

According to Vanda Research, on May 13, GameStop had a net inflow of retail trader money totaling over $15.8 million. However, these numbers pale in comparison to the peak inflows seen during the height of the meme stock craze in late January 2021, with GameStop hitting around $87.5 million.

The resurgence of interest in meme stocks was sparked by a rare social media post from Keith Gill, also known as ‘Roaring Kitty,’ where he shared a meme suggesting intense engagement with video games.

This renewed excitement pushed GameStop stock up by more than 70% on May 13, with gains continuing into May 14. However, the enthusiasm seemed to fizzle out by the end of the day.

However, some analysts, like to rely on technical indicators, such as the fake head and shoulders in which case retail investors get spooked and decide to divest, causing the stock to surge, according to Nebraskan Gooner post on X on May 16.

Another meme stock, AMC also experienced the same fate

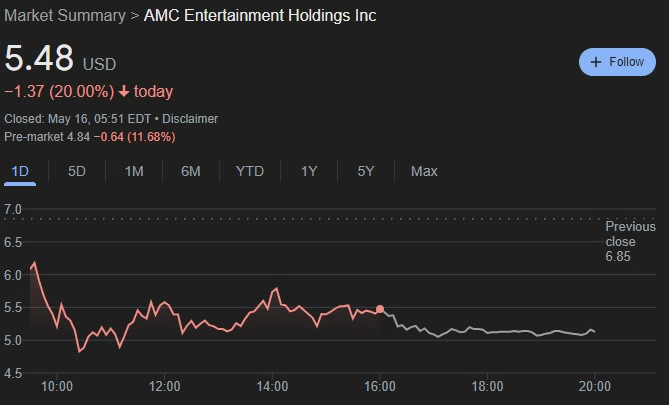

Similar to GME, AMC Entertainment (NYSE: AMC) stock soared by 135% this week, only to experience losses of 20% in the latest trading session, which extended to premarket by 11.68%.

AMC’s drop was partly triggered by the company’s announcement of a deal to swap debt for equity. In this deal, AMC will exchange 23.3 million shares for $163.9 million worth of bonds that are due in 2026. Additionally, AMC had recently completed a $250 million stock sale on May 13.

Lasting much shorter than the previous meme stock frenzy, the stocks managed to initially add over $10 billion to their market caps, while inflicting billions in losses to short-sellers, before suffering declines themselves.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.