As the stock price of semiconductor giant Nvidia (NASDAQ: NVDA) continues to trade in the red, the company is back in focus due to significant insider selling.

It’s worth noting that, following a sustained rally with NVDA shares in 2024, the stock has witnessed a substantial offloading of equity by Nvidia executives, leading to speculation regarding a possible downturn.

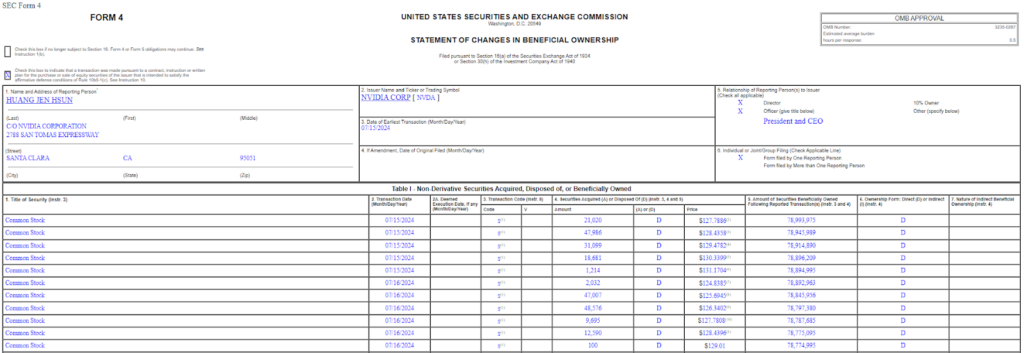

The most notable recent selling activity comes from CEO Jen-Hsun Huang, who sold 700,000 company shares last week. Filings also indicate that Huang offloaded stock worth $30.6 million earlier this week. The transaction, executed between July 15 and 16, saw Huang selling shares priced between $126.34 and $130.34 each.

Notably, he sold another $30.7 million shares between July 5 and July 8 and $169 million during the last week of June. Despite the sale, Huang still holds a significant number of shares, at 78.7 million.

This sale raises eyebrows among investors, prompting many to potentially reevaluate their positions. Huang’s and other executives’ selling activity has been interpreted by some market analysts as a lack of confidence in the company’s near-term stock performance, potentially signaling a more extended period of decline.

However, these sales align with the Rule 10b5-1 trading plan, which Huang adopted on March 14, 2024. This initiative enables insiders to sell a predetermined number of shares at a predetermined time, providing a legal cushion against potential accusations of insider trading.

Key Nvidia levels to watch

In the meantime, as Nvidia records sustained insider trading activity, the stock has faltered in recent trading sessions. Notably, NVDA has lost the crucial $120 support level, plagued by geopolitical factors affecting the semiconductor sector.

In determining Nvidia’s next move, stocks trading expert by the pseudonym Vnkumar Trades, in an X post on July 18, outlined key levels to watch for NVDA shares.

According to the post, Nvidia’s share price has several critical support levels at $116, $114.5, and $110. The $116 level aligns with the 50-day exponential moving average (EMA), a technical indicator often used by traders to gauge the stock’s momentum and potential reversal points.

The subsequent support levels at $114.5 and $110 are also crucial, representing previous lows and psychological benchmarks that traders will keenly observe.

On the upside, Nvidia’s stock faces resistance at $120.5 and $122. These resistance levels are vital for investors to monitor because breaking through could indicate a potential recovery and renewed upward momentum.

The resistance at $120.5 and $122 is particularly significant as it suggests where selling pressure might intensify, preventing the stock from moving higher.

The analysis showed that following the 10-for-1 stock split, Nvidia’s stock peaked at around $135.56 before experiencing a pullback.

NVDA share price analysis

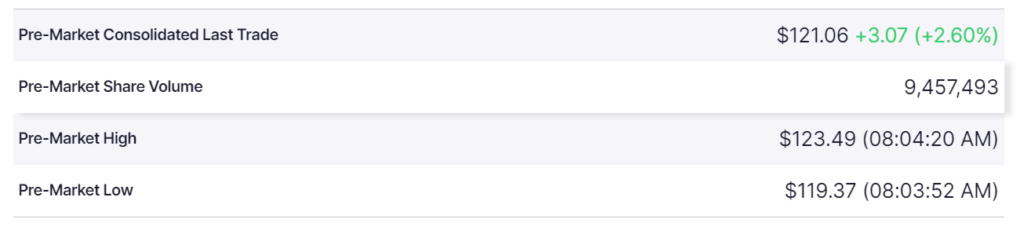

As of the latest market close, the stock is trading at $117.99, down 6.62% for the day.

However, the stock’s pre-market shows some signs of recovery, with the equity gaining over 2% and trading at $121.

With Nvidia’s stock significantly impacting the overall artificial intelligence (AI) rally, attention is on the bulls to avoid further pullbacks. Their target remains to reclaim the $120 resistance level.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.