The ongoing bullish sentiment that has swept the majority of assets in the cryptocurrency sector has not left out Ethereum (ETH), and machine learning and artificial intelligence (AI) algorithms predict more advances for the largest altcoin by market capitalization in the near future.

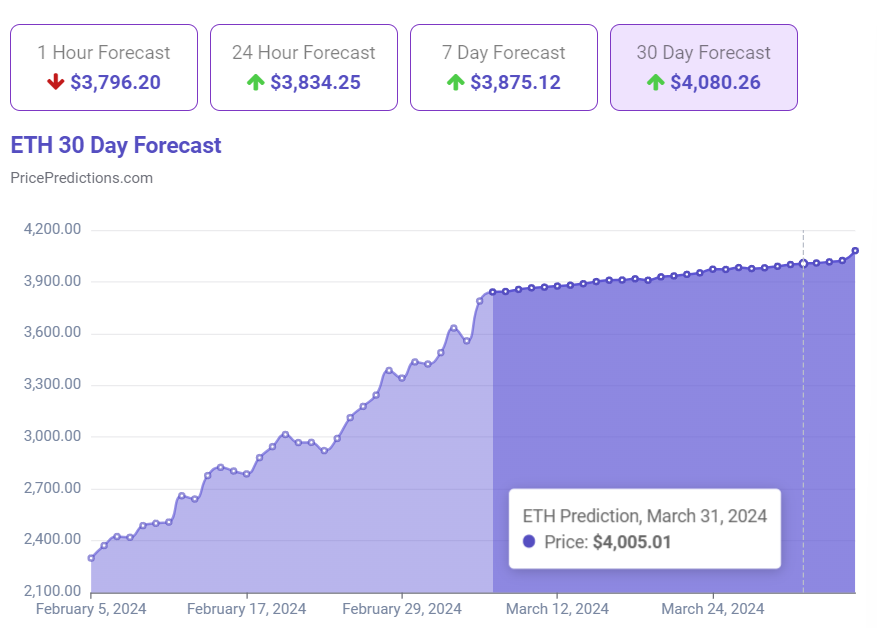

Specifically, Ethereum could continue to improve its price this month, possibly even reaching $4,005.01 by March 31, 2024, according to the latest predictions by the advanced price projection algorithms developed by the crypto analytics and forecasting platform PricePredictions, per data on March 6.

In other words, Ethereum could increase by 4.65% by that time, provided that the algorithm, which relies on indicators like average true range (ATR), moving average convergence divergence (MACD), relative strength index (RSI), and Bollinger Bands (BB), proves correct.

Ethereum price analysis

As of the time of publication, Ethereum was changing hands at the price of $3,826.96, indicating an increase of 1.45% on the day, as well as adding 13.62% in the last week, attaining an advance of 64.35% on its monthly chart, according to the most recent data.

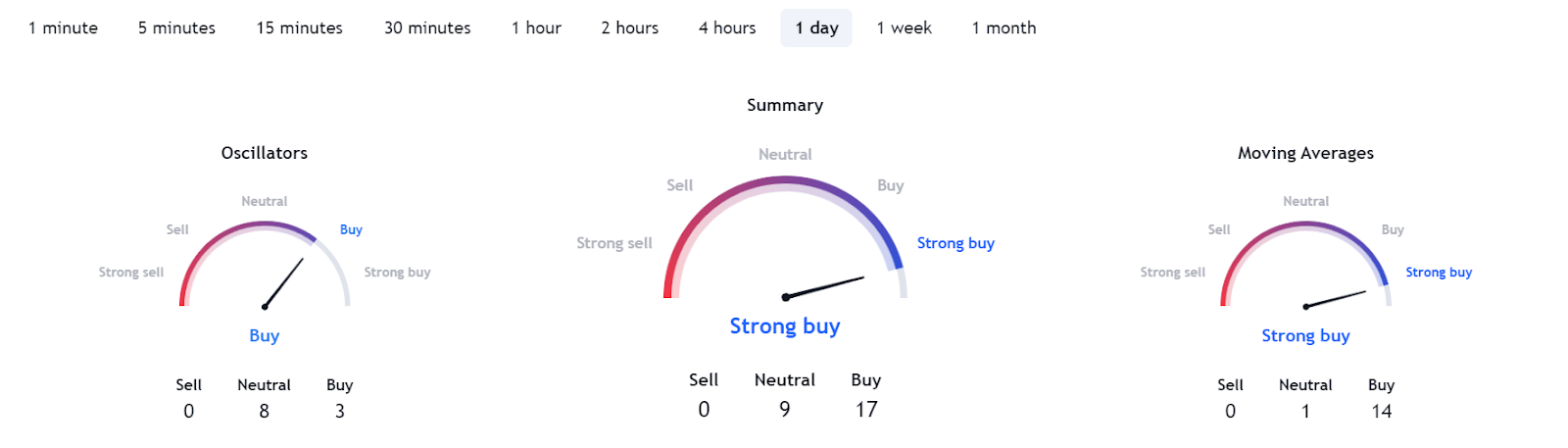

Meanwhile, the popular digital asset is boasting a ‘strong buy’ sentiment on all of its technical analysis (TA) gauges based on oscillators and moving averages (MA) both demonstrating optimism, according to the information retrieved from finance and crypto analytics website TradingView.

Bullish factors

All things considered, Ethereum could, indeed, increase its price and reach the target set by the machine algorithm, provided it retains its bullish momentum, aided by the potential for an Ethereum spot exchange-traded fund (ETF), which could significantly impact price in the coming months.

On top of that, as crypto trading expert Michaël van de Poppe noted in his analysis, the Ethereum ecosystem is looking forward to a major network upgrade called Dencun on March 13, which in itself could boost the optimistic sentiment for the asset that is “the next in line for a potential all-time high test.”

That said, things in this industry may sometimes change on a whim, which is why it is critical to carry out one’s own detailed research and weigh all the risks, as well as keep up with the related developments before investing a significant portion of money into any asset.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.