Palantir (NYSE: PLTR) has spent the previous period in the process of diversification that would broaden its portfolio to industries, companies, and sectors that aren’t government-backed to grow its revenue and increase appeal among investors.

These attempts haven’t gone unrecognized with big industry players, as Microsoft’s (NASDAQ: MSFT) CEO, Satya Nadella, called Palantir a ‘‘leader in their industry” during the July 30 Q4 earnings call.

“The number of paid models-in-service customers has more than doubled QoQ, and we are seeing increased usage by leaders in every industry, from Adobe and Bridgestone to Novo Nordisk and Palantir,” said Nadella.

Palantir stock price analysis

Gains of 2.79% were recorded during the July 31 trading session, setting the price of PLTR stock at $27.11 at the time of writing.

These gains build on a positive performance of 4.19% in the previous five trading sessions, helping PLTR shares increase their valuation by 63.51% year-to-date (YTD).

Technical analysis of PLTR stock price chart

According to the most recent technical analysis of Palantir shares, indicators point towards a “buy” valuation.

Further examination of simple moving averages (SMA) over different periods (20, 50, and 200-days) reveals that the only level PLTR stock has yet to surpass is the 20-day SMA.

The stock’s recent performance, with a 4.19% gain over the past five trading sessions, aligns with the bullish signals from the 50-day and 200-day SMAs. However, the inability to break through the 20-day SMA suggests a potential short-term pullback or consolidation phase.

If PLTR can sustain its momentum and break through the 20-day SMA, it may target the next resistance level around $27.50. Conversely, the $25.36 level acts as a support.

Combined with a rising relative strength index (RSI) rating of 52, which hovers around neutral territory, this trend has sparked increased buying pressure for PLTR shares over the recent period.

What does Wall Street predict for PLTR shares?

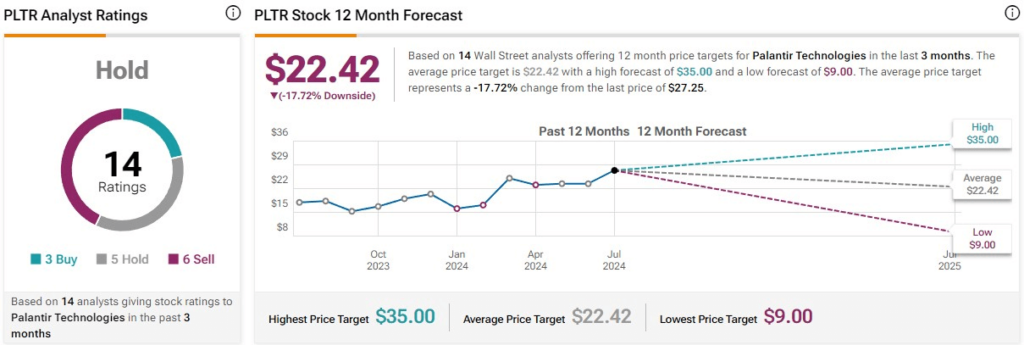

Wall Street experts tend to maintain their focus on fundamental analysis and growth prospects of a targeted company, which for Palantir presents an issue, as it trades at a high P/E ratio, making it a “hold” among experts. Of 14 evaluations, 3 advise a “buy,” 5 to “hold,” and 6 to “sell,” thus sending mixed signals on this artificial intelligence (AI) stock.

The average price target remains below the current valuation, with a potential downside of 17.48%, indicating a reversal to $22.42.

According to the most recently released price target from larger Wall Street institutions, Citi analysts anticipate Palantir will exceed earnings forecasts in its Q2 earnings report on August 5, driven by its commercial segment and the growing momentum of its AI Platform (AIP).

As a result, Citi has raised its price target to $28 from $25 on July 30. Analysts predict revenue growth of 22.34% to $652 million and EPS of 3 cents, up from 1 cent a year ago. Jefferies also increased its price target to $28, while maintaining a “hold” rating, noting Palantir’s high valuation.

Despite endorsements by prominent CEOs, Palantir will have to demonstrate more diversification and revenue streams if it wishes to convince Wall Street analysts. Right now, its fundamentals remain lacking.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.