While other artificial intelligence (AI) focused stocks like Nvidia (NASDAQ: NVDA), Qualcomm (NASDAQ: QCOM), and Micron (NASDAQ: MU) have seen impressive gains in 2024, their competitor Advanced Micro Devices (NASDAQ: AMD) has struggled, as it managed to eke out “just” a 13% gain in the first half of the year.

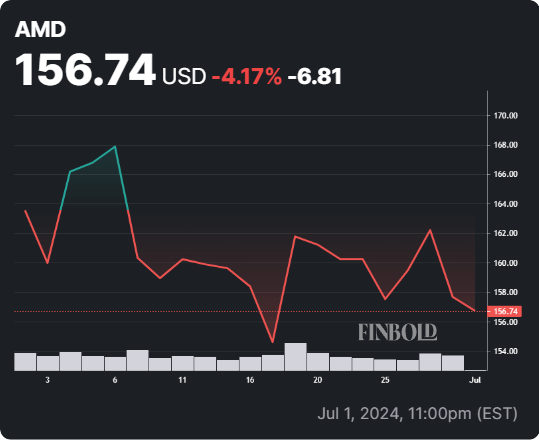

The recent trend hasn’t been positive, as AMD shares lost 2.79% in the latest trading session, with losses of 1.89% extending in the previous five trading days.

Zooming out, the narrative doesn’t seem to change, as the monthly chart shows a 3.58% drawback.

Are AMD shares set to suffer further, or is there light at the end of the tunnel for this chipmaker stock?

Technical analysis flashes warning signs for AMD stock

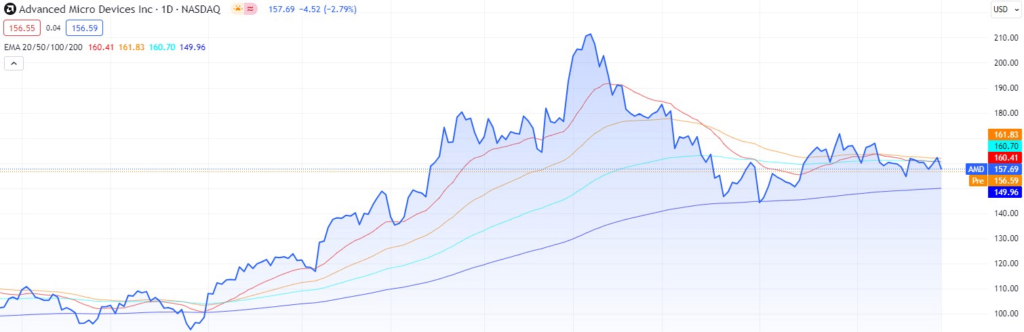

Technical analysis for AMD stock spells out a cautionary story for investors as most indicators flash a red signal on this semiconductor stock.

The stock’s future direction will be heavily influenced by its ability to break through the critical support and resistance levels at $141 and $174, respectively.

Additionally, the falling relative strength index (RSI) is a cautionary signal, suggesting that a downward trend can continue in the upcoming trading sessions.

One of the rare indicators that spells hope for AMD shares is its 200-day simple moving average (SMA) at $149.96, as other shorter ranges have already given up support.

Analysts have never been more bullish on AMD stock

Where some see danger, others see opportunity, which is certainly exemplified in the AMD stock’s case, as the divide between technical indicators and analysts’ opinions has never been wider.

Analysts believe the current price for AMD stock presents a great entry point, as the general sentiment on Wall Street is a “strong buy.” Of 35 analysts, 28 recommended a “buy,” while seven opted for “hold,” and none advised a “sell.”

The average price target for AMD stock is set at $191.03, which represents a potential 21.14% upside from current price levels.

Maybe the sentiment on Wall Street is best summarized by Piper Sandler analysts, who have named Advanced Micro Devices stock their top large-cap pick for the second half of 2024 based on positive feedback from recent discussions with AMD’s management in Europe.

The investment bank was impressed with AMD’s strategic positioning, particularly for its MI300 accelerator series, which is projected to surpass $4 billion in revenue this year. Analysts noted that the embedded segment has likely bottomed out in the June quarter, leading to a bright outlook for AMD in the latter half of the year.

Additionally, GPU supply is expected to improve, and AMD’s valuation remains attractive compared to peers in the computing space.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.