As artificial intelligence takes the forefront across industries, robotics emerges as a cost-effective and efficient solution for production. This has led to a remarkable increase in valuations for semiconductor companies, with Nvidia (NASDAQ: NVDA) and SuperMicro (NASDAQ: SMCI) serving as prime examples.

However, among these, there’s a sleeping giant—Intel (NASDAQ: INTC)—which once dominated the industry and now may be on the verge of a resurgence.

Intel is embarking on a significant investment initiative, aiming to allocate $100 billion across four U.S. states for the construction and expansion of factories. This endeavor follows the company’s acquisition of $19.5 billion in federal grants, comprising $8.5 billion in grants and $11 billion in loans.

How is Intel stock reacting to this news?

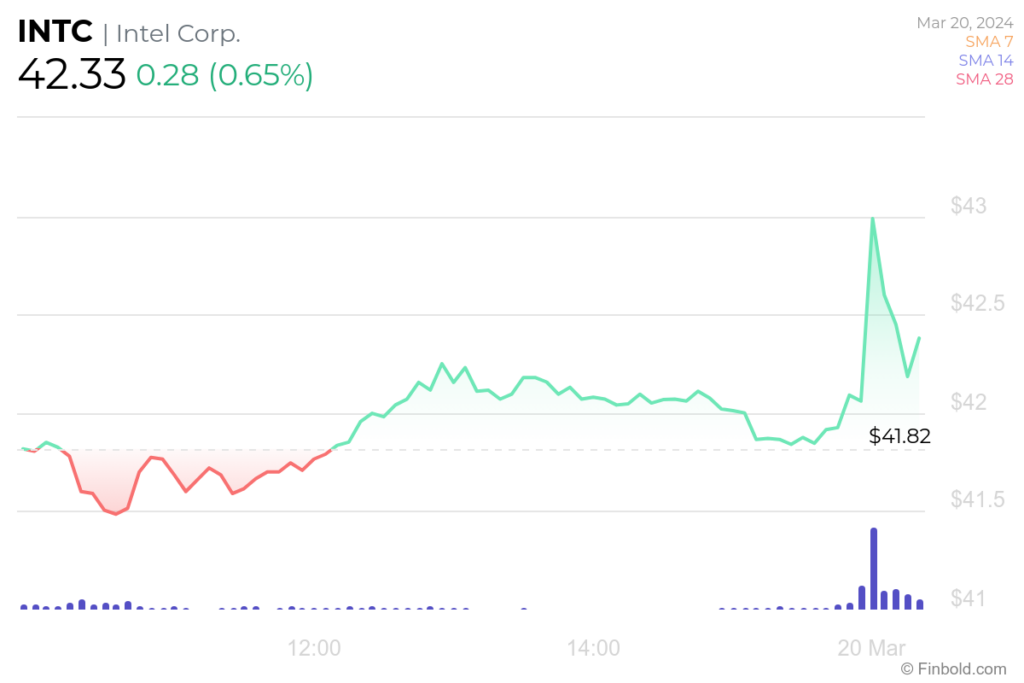

Since the markets opened on March 20, INTC stock has risen by 0.65%, reaching a valuation of $42.33.

This uptick marks a stark contrast to the losses of -2.11% observed over the past five trading sessions, as well as the -11.45% decline since the beginning of 2024.

INTC stock has shown a downward trend during this period. The closest support zone for INTC stock is at $41.19, indicating a tendency for the price to stabilize around this level. On the other hand, the closest resistance zone is at $43.43.

If the stock manages to surpass this level, it could potentially propel INTC’s share price toward a $50 valuation. The last time INTC reached this level was in December 2023.

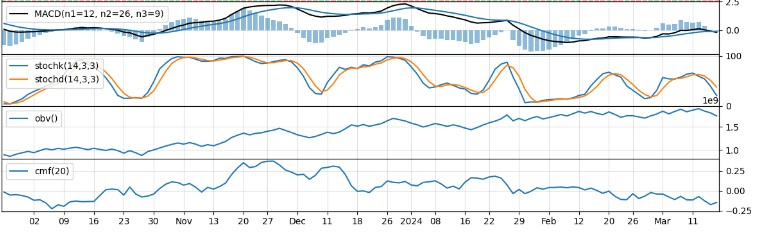

However, INTC stock is currently in a bearish phase. Trend indicators suggest a weakening trend, with the MACD indicating negative momentum. Momentum indicators also support this bearish view, with the Stochastic Oscillator. Moreover, volatility indicators suggest decreasing volatility, possibly leading to a consolidation phase.

Taking the overall technical picture into account, it’s probable that INTC may continue to decline in the coming days. However, it’s important to note that these technical signals haven’t yet incorporated recent news and shifts in market sentiment.

Will the government investment bolster INTC stock?

While it’s difficult to predict whether the $20 billion investment will cause Intel shares to surge at a pace similar to its rivals and reach the $50 threshold, it’s certainly a strong possibility. Historically, government contracts have had a notable impact on the stock market performance of various companies.

Moreover, Intel has been making strides in producing advanced AI chips in recent months, exemplified by its Gaudi3.

When considering the government investments, internal advancements, the recent uptrend in the stock market, and the overall state of the microchip industry, there’s a compelling likelihood that Intel shares could experience a substantial recovery in the near future.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.