In this guide, we will present a detailed, step-by-step method for buying index funds in the UK, delving into the pros and cons of investing in such funds, providing practical tips for a fruitful investing experience, and recommending the best brokers to consider.

Highly Rated Stock Trading & Investing Platform

-

Invest in stocks, ETFs, options and crypto

-

Copy top-performing crypto-traders in real time, automatically.

-

0% commission on buying stocks - buy in bulk or just a fraction from as little as $10. Other fees apply. For more information, visit etoro.com/trading/fees.

-

eToro USA is registered with FINRA for securities trading.

What is an index fund?

Note

A market index is a basket of assets that mirrors a particular part of the economy. You can find index funds for almost any market or strategy you can think of. Some hold shares from thousands of different companies from all over the world. Others are concentrated, focusing on a single country or industry, and may comprise just a handful of companies.

An example of a broad market index is the Financial Times-Stock Exchange 100 Share Index (FTSE 100), colloquially known as Footsie, an index of the largest blue chip companies listed on the London Stock Exchange (LSE). The FTSE 100, accounting for over 80% of the LSE’s market capitalization, serves as a barometer for the health of the UK stock market and the broader economy.

Index investing is a widely used form of passive investing whereby you invest in an index fund and receive a diversified mix of securities in a single, cost-efficient investment.

How to buy index funds in the UK: step-by-step

In order to invest in index funds in the UK, you’ll need an account with an investing platform or online stock broker. To begin your investing journey, follow the steps outlined below.

Step 1: Select a broker

Opening a brokerage account may seem intimidating, but it’s actually as straightforward as opening a bank account. When choosing a broker to invest in index funds in the UK, consider the following factors:

- Fees: Brokerage fees are costs levied by brokers to execute your trades. Fortunately, most online brokers nowadays offer commission-free ETF and stock trading;

- Security: Make sure the broker you opt for is fully regulated by the Financial Conduct Authority (FCA);

- Convenience: If you’re new to stock trading, a user-friendly platform with an easy-to-navigate interface is advisable. A section with investing tips and tricks might also come in handy. And if you like to keep an eye on your investments at all times, look for a platform that offers a mobile solution;

- Access to market data: Go for a platform that offers access to reliable market research and reporting tools to help you invest confidently with updated data;

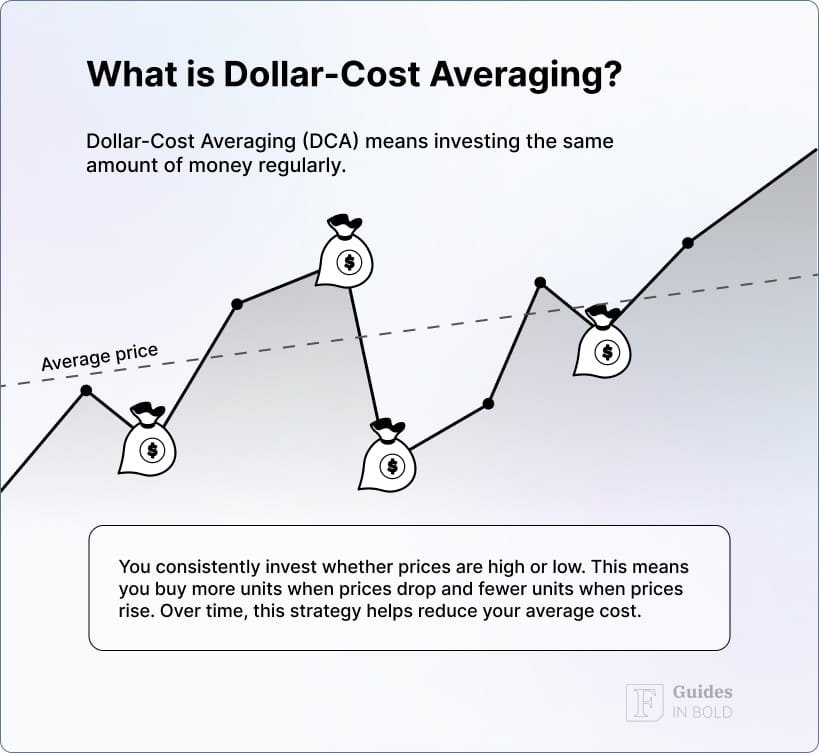

- Fractional stock trading: Fractional shares allow investors to buy ETFs based on the cash amount rather than the number of shares and are particularly useful for cash-strapped investors who want to build a diversified portfolio or set up a dollar-cost averaging strategy.

Where to buy index funds in the UK?

Thanks to the many online brokers and investment platforms, the stock market has become more accessible and affordable than ever before. Nevertheless, selecting the right broker that aligns with your unique requirements (investment goals, learning resources, and trading approach) is vital for a smooth trading experience.

To securely invest in index funds in the UK, make sure to use an FCA-regulated exchange such as eToro, which offers:

- Commission-free stock and ETF trading;

- 2,000+ stocks from 17 exchanges;

- 300+ ETFs;

- Fractional shares available;

- User-friendly platform.

Highly Rated Stock Trading & Investing Platform

-

Invest in stocks, ETFs, options and crypto

-

Copy top-performing crypto-traders in real time, automatically.

-

0% commission on buying stocks - buy in bulk or just a fraction from as little as $10. Other fees apply. For more information, visit etoro.com/trading/fees.

-

eToro USA is registered with FINRA for securities trading.

Step 2: Pick the index fund

As mentioned earlier, there’s an index fund for nearly every index, allowing you to choose one that aligns with your investment strategy.

For instance, if you want extensive and diversified exposure to the stock market, you could invest in a broad market index fund like the S&P 500 or FTSE 100. Alternatively, if you’re interested in socially responsible investing, you can choose an index fund that promotes environmental, social, and governance (ESG) factors. This way, your financial gains align with your ethical convictions.

Note that standard index funds often include companies that may not align with ESG criteria, such as those in the banking, mining, gambling, and tobacco industries. Therefore, based on your investment principles, it’s crucial to examine the composition of your index fund. Understand what sectors or types of businesses it includes and excludes, ensuring it aligns with your personal values or desired investment strategy.

Once you’ve chosen an index, you can usually find at least one ETF that tracks it. With popular indexes like the S&P 500, you’ll have several options.

What to consider when choosing ETFs

Given the abundance of choices, make sure to consider the following factors when choosing ETFs:

- Holdings: Look at the asset class the index fund is based on. For diversification purposes, investing in a fund based on a broad, popular index may be better than a small, obscure one;

- Asset level: An ETF should have a minimum level of assets to be a viable choice, generally at least $10 million. ETFs with assets below this threshold may have limited investor interest, leading to poor liquidity and broad spreads;

- Trading volume: High trading volume indicates better liquidity and tighter bid-ask spreads, essential for when you’re ready to sell;

- Tracking Error: Some ETFs don’t track their underlying indexes as closely as they should. An ETF with minimal tracking error is generally preferable;

- Costs: The expense ratio represents the percentage of your investment that goes towards administrative costs. Even though two funds may aim to track the same index, such as the S&P 500, their management costs can differ enormously. And though a slight increase in the percentage of fees might not seem significant at first, it can considerably impact your long-term investment returns. Usually, bigger funds tend to have lower fees;

- Performance: Funds with a solid track record may be a safer choice. That said, remember, past performance shouldn’t be used as an indication of future returns.

Remember

Step 3: Decide your investment amount

After you’ve chosen an index fund, the next step is to decide how much you want to invest.

Your investment amount will hinge on the price of the index fund and the number of shares you wish to purchase. If the share price of the fund you’re interested in is financially out of reach, you can consider fractional shares, which will allow you to purchase shares based on the GBP amount you’re comfortable with.

Given the unpredictability of the stock market, it’s crucial you invest only what you can afford to lose.

Funding your account

Step 4: Execute your order

Once you’ve decided on the cash amount or the number of shares you wish to invest in, you can place your order by entering the ticker symbol of the index fund in the search bar. Your transaction should be executed within seconds (in the case of a market order), after which your portfolio will be updated to reflect the newly acquired shares.

A buy order can be executed in two ways:

- Market order: A market order is a command to buy the asset at the current market price and is typically executed immediately (subject to availability);

- Limit order: A limit order, on the other hand, is activated once the security hits your designated price.

Profiting from a falling market

Step 5: Develop your portfolio

The number of index funds you should have in your portfolio depends on how diversified those funds are. For example, you might only need one or two if you’re investing in broad-market index funds that cover a wide range of sectors and industries. On the other hand, if you’re focusing on narrower funds within specific sectors, you’ll likely need more to ensure proper diversification.

You could also invest most of your money in a broad market index fund, like the S&P 500, and set aside a smaller amount to explore specific target areas.

While the urge to monitor your investments daily might be strong, particularly when you’re just starting out, adopting a long-term view is essential. Remember, all investments come with risk, and index funds will reflect the market’s fluctuations. If the index loses value, the fund will too. However, the stock market tends to rise over time, so index funds that track these indexes will also increase in value. In the end, index funds are cost-effective, offer diversification, and have a history of producing solid returns over the long run.

Recommended video: Warren Buffet on index funds

Next, we’ll delve deeper into what index funds to choose for your investment portfolio.

Best UK index funds to invest in

The right index fund for you will depend on various factors, including your financial goals, risk tolerance, and investment timeline. That said, here are three index funds to consider:

- iShares Core FTSE 100 UCITS ETF: This ETF mirrors the UK’s premier index, which contains the country’s top 100 companies leaning heavily toward the finance, oil, gas, and mining sectors. Although these sectors’ performance tends to be influenced by economic conditions, and the index may not have grown as robustly as some international counterparts, it stands out for its potential to generate passive income. And while the companies in the FTSE 100 might not offer the same growth as US tech giants like Apple (NASDAQ: AAPL) and Amazon (NASDAQ: AMZN), they pay generous dividends, with an annual yield of around 3.5%;

- Vanguard FTSE 250 UCITS ETF (LSE: VMID): This index fund offers investors a chance to invest in a broader range of companies in the UK. The FTSE 250 index includes all the FTSE 100 companies plus an extra 150 with smaller market capitalizations. And while this can lead to increased volatility, the index has traditionally delivered higher returns than the FTSE 100 alone;

- SPDR S&P 500 UCITS ETF (LSE: SPY5): Similar to the FTSE 100, the S&P 500 contains the 500 largest US companies. While the index fund is traded on the London Stock Exchange, it consists exclusively of American stocks. The S&P 500 has historically been a significant source of growth, with an average annualized return of about 10%.

Pros and cons of investing in index funds in the UK

To help you decide whether index funds are a suitable investment, let’s look at the key pros and cons of investing in index funds in the UK. However, it’s worth noting that this list is not exhaustive, and there may be other factors to consider when deciding whether or not to invest in index funds. Moreover, as with all financial instruments, the outcomes will vary depending on individual circumstances, investment goals, and time horizons.

Pros

- Solid performance: Index funds have consistently beaten other types of funds in terms of returns;

- Instant diversification: These funds spread your investment across a broad range of assets, reducing risk. Even if one stock performs poorly, others might do well;

- Cost-effective: Index funds usually cost less than alternatives like actively managed funds. Their operating costs are lower as they simply replicate their designated index rather than needing active trading and research;

- Convenience: Such funds contain hundreds or even thousands of stocks that would be incredibly hard to replicate on your own;

- Low maintenance: Index funds require less portfolio rebalancing. The fund handles all allocation shifts within the index;

- Transparency: Most index funds hold what’s in the index, so you know exactly what you’re investing in;

- Tax efficiency: Since index funds are passively managed with infrequent trading, they generate less taxable income.

Cons

- Inability to handpick stocks in the index: Index funds may contain shares you might not want to own. Depending on the index, there’s a chance you might end up with stocks you’d prefer to avoid while missing out on others you’d like to own;

- No chance to outperform the market: Index funds are designed to replicate the market’s (or sectors’) performance through ups and downs, and when the market plummets, you’re fund will follow suit;

- Limited returns: Diversification is a double-edged sword, and while it reduces risk by leveling out market volatility, it also potentially caps the upside. By safeguarding against the lows, it inherently limits the highs.

In conclusion

Typically, investing in the stock market involves a lot of complex tasks, including monitoring performance, analyzing company fundamentals, reviewing earning reports, and so forth. These tasks can be demanding, consuming significant time and effort. Investing in an index fund, however, will streamline that entire process.

In short, by merely mirroring the performance of the market, index funds have the potential to grow your initial investment into a sizable nest egg over the long term. And the best part, you don’t need to be an expert on the stock market to achieve this. That said, as with any investment, consider the pros and cons of this approach before investing any money.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

FAQs about how to invest in index funds in the UK

How to invest in index funds in the UK?

To invest in index funds in the UK, you’ll need an account with a regulated online broker. Once you have deposited funds to your account, you can purchase index funds using their ticker symbol, similar to how you’d buy stocks.

Where to buy index funds in the UK?

In the UK, you can buy index funds through FCA-regulated online brokerages such as eToro.

Is it worth investing in index funds?

Index funds are excellent investments for long-term investors. They offer broad coverage across various market sectors, geographic regions, and industries, allowing investors to diversify their portfolios rapidly and efficiently, reducing overall risk, as market fluctuations tend to be less volatile across an index than individual stocks.

Why should I invest in index funds?

Investing in index funds is less expensive, easier, and frequently generates better after-tax outcomes over medium to long-term periods than actively managed portfolios.

Highly Rated Stock Trading & Investing Platform

-

Invest in stocks, ETFs, options and crypto

-

Copy top-performing crypto-traders in real time, automatically.

-

0% commission on buying stocks - buy in bulk or just a fraction from as little as $10. Other fees apply. For more information, visit etoro.com/trading/fees.

-

eToro USA is registered with FINRA for securities trading.