This guide will investigate the life and career of Robert Kiyosaki and examine some of his unconventional investing advice. Moreover, it will also summarize and analyze his international bestseller Rich Dad Poor Dad and dissect both the helpful and questionable guidelines it presents.

Best Crypto Exchange for Intermediate Traders and Investors

-

Invest in cryptocurrencies and 3,000+ other assets including stocks and precious metals.

-

0% commission on stocks - buy in bulk or just a fraction from as little as $10. Other fees apply. For more information, visit etoro.com/trading/fees.

-

Copy top-performing traders in real time, automatically.

-

eToro USA is registered with FINRA for securities trading.

Related reads:

Who is Bernie Madoff? History’s Largest Ponzi Scheme Explained

Who is Jordan Belfort? True Story of “The Wolf of Wall Street”

Who Started Bitcoin? The True Story of Satoshi Nakamoto

Who Is Michael Burry? “The Big Short” Briefly Explained

Who is Robert Kiyosaki?

On the back of the success of Rich Dad Poor Dad, he built the Rich Dad brand that encompasses financial education companies that provide personal finance and business education through books, games, and videos. However, the primary revenue comes from franchising the Rich Dad brand out to private entities that run personal finance and real estate seminars.

He has authored (or co-authored) more than 26 books since Rich Dad Poor Dad, including two with the television personality and twice-impeached president Donald Trump. The overarching financial themes and advice throughout these books include:

- The importance of financial education;

- How to make money work for you, i.e., building up passive income (particularly through real estate);

- The difference between assets and liabilities;

- It’s not how much money you make; it’s how much you keep;

- A lifetime of working for someone else can lead to financial struggles.

Unfortunately, Kiyosaki’s advice has come under fire for emphasizing financial anecdotes that constitute a “get-rich scheme” and containing little tangible guidance on how exactly to make it big, as well as advocating for practices of debatable legality, not to mention his lawsuits with former associates and controversies surrounding his seminars.

Investing for beginners:

- What is Investing? Putting Money to Work

- 17 Common Investing Mistakes to Avoid

- 15 Top-Rated Investment Books of All Time

- How to Buy Stocks? Complete Beginner’s Guide

- 10 Best Stock Trading Books for Beginners

- 15 Highest-Rated Crypto Books for Beginners

- 6 Basic Rules of Investing

- Dividend Investing for Beginners

- Top 6 Real Estate Investing Books for Beginners

Robert Kiyosaki’s early life and career

Robert Kiyosaki was born in Hilo, Hawaii, in 1947. After graduating from Hilo High School in 1965, he attended college at Kings Point Merchant Marine Academy in New York, eventually enlisting in the Marine Corps as a helicopter gunship pilot during the Vietnam War.

After serving in the military, Kiyosaki worked in the sales department at Xerox Corporation, fine-tuning the sales techniques that would characterize the career on the horizon. From there, “his entrepreneurial spirit kicked in” as he moved to try his hand at business.

After a few years at Xerox, Kiyosaki launched his first company, Rippers, selling surfer-style nylon and Velcro wallets. Unfortunately, the business eventually went bankrupt. Nonetheless, he tried his luck again at the beginning of the 1980s, starting a company that licensed T-shirts for heavy metal rock bands. However, in 1985, that company, too, became insolvent.

Despite two failed businesses, Kiyosaki took to educating people about personal finance. Soon, he started work as a motivational speaker for a personal growth seminar firm called Money and You, along with D.C Cordova, that taught business and investing to tens of thousands of students worldwide.

The success of that venture allowed Kiyosaki to retire in 1994, only at the age of 47. Nonetheless, upon retirement, Kiyosaki continued his investments in real estate and the stock market and began work on the project that would define his career.

Robert Kiyosaki’s success story

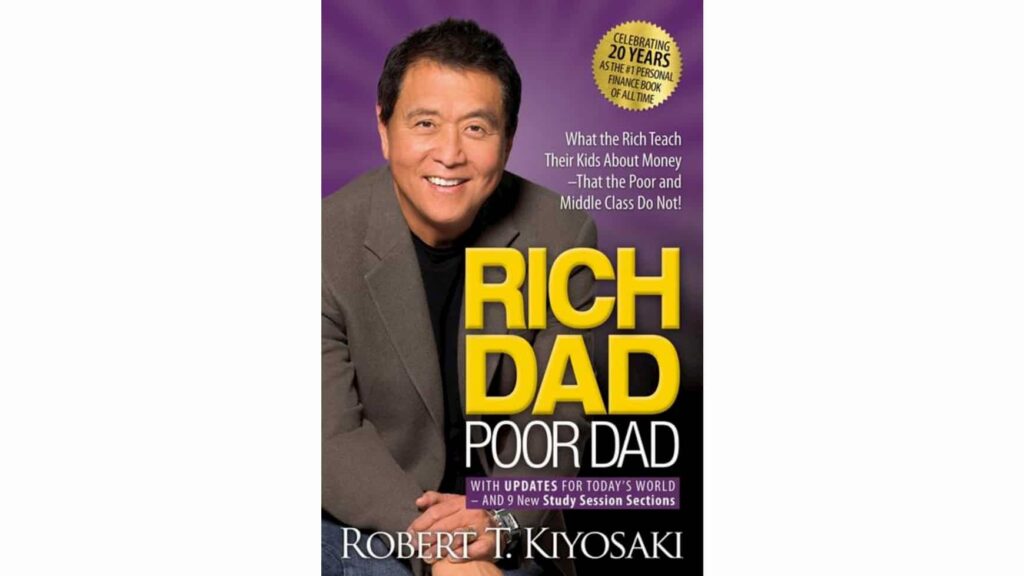

Kiyosaki’s big break came in 1997 when he (self-) published Rich Dad Poor Dad. Ostensibly based on his childhood, Kiyosaki contrasts his two dads and the lessons he learned from them. The book advocates for the power of financial education, financial independence, and building wealth through income-generating assets, as well as not spending money you don’t have.

The titular “poor dad” refers to his birth father, an accomplished academic who worked hard all his life yet never achieved financial security, as opposed to the “rich dad,” who, though a high-school dropout, became a successful entrepreneur and savvy investor. The “rich dad” allegedly refers to Kiyosaki’s best friend’s dad, though his existence has been questioned.

Recommended video: The Biggest Mistake Young People Make – Robert Kiyosaki

Rich Dad brand

Kiyosaki milked the success of his book to create a brand around Rich Dad with his wife Kim, launching a bundle of educational activities and projects around personal finance, including the Cashflow board game.

The American entrepreneur operates through several companies he owns and through franchisee arrangements with other companies or individuals authorized to use his brand name for a fee. This includes Rich Dad LLC, Whitney Information Network, Rich Dad Education, and Rich Dad Academy.

Kiyosaki and his wife also run an active YouTube channel with millions of subscribers. His pitch to viewers:

This our story, and today we share with you our formula to millions, the game of the rich, and how we choose to fight academia with capitalism.

Robert Kiyosaki’s net worth is around $100 million.

Controversial seminars

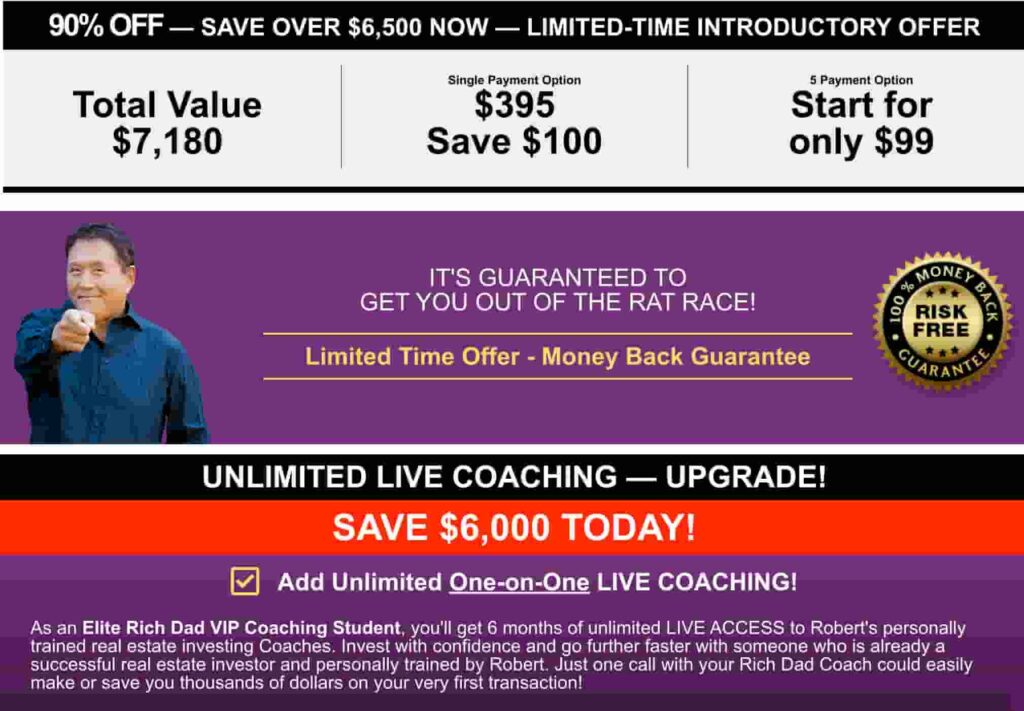

In 2010, Allan Roth of CBS News documented the events that transpired when he attended one of Rich Dad’s real estate seminars in Canada, uncovering (via hidden cameras) the dubious, intimidatory tactics Kiyosaki’s franchisees implemented.

For example, at a $500 seminar in Kitchener, Ontario, participants were pressured into raising their credit-card limits (to finance their real estate goals) right on the spot, even given scripts coaching them on how to ask for limits of $100,000.

Additionally, it seemed that the first free seminar acted as an advertisement to get the following workshop at half price, rendering the program nothing more than a sales pitch for more advanced courses (some of which were priced between $12,000 and $45,000).

In fact, in the same interview, Kiyosaki admitted that his classes are taught by instructors that use more than questionable practices but that he is not in control of his training seminars, even though they’re part of his company Whitney Information Network.

Important

Rich Dad Poor Dad

Rich Dad Poor Dad is Kiyosaki’s story of growing up with two fathers — his biological father (Poor Dad) and the father of his childhood best friend Mike (Rich Dad) — and how both men shaped his approach to money and investing. Throughout the book, Kiyosaki compares both dads, their beliefs, financial practices, ambition, and how his birth father, though a highly educated government employee, paled against his rich dad regarding asset building and business acumen.

The author equates the Poor Dad to those eternally caught up in the “rat race,” i.e., the fierce 9-5 grind that fails to lead to financial freedom because of one glaring lack: financial literacy (Kiyosaki relates this to poor financial education given to kids at school). The Rich Dad, on the other hand, symbolizes the highest echelon of society, the ones who take advantage of the power of corporations and apply their tax and accounting knowledge (or that of their tax advisers) for their benefit.

To escape the rat race and achieve financial independence, Kiyosaki recommends and dissects in his book the following concepts:

- The importance of being your own boss;

- Stop working for money; let money work for you;

- The difference between an asset (e.g., stocks, bonds, income-generating real estate) vs. a liability (owning your home);

- The importance of financial literacy: gain knowledge of accounting, loopholes, markets, investing, and the law;

- Work to learn, not for money;

- Overcoming obstacles by not fostering fear, cynicism, laziness, bad habits, and arrogance;

- The power of corporations contributes to making the rich even richer.

The problem with Poor Dad

Poor Dad holds up education and hard work as the passport to success. Consequently, the author likens him to the millions of fathers who encourage their children to do well in school to increase their chances of securing a good job. However, according to the narrative, though the Poor Dad worked hard all his life, he somehow never made it ahead financially.

In contrast, Rich Dad, though an eighth-grade dropout, managed to outsmart the intellectuals because he understands money (and knows how to manipulate the system to his favor), ultimately becoming a multimillionaire entrepreneur.

Kiyosaki concludes that Poor Dad’s approach to money was based on working hard to have enough money to pay the bills, in contrast to Rich Dad, who knew how to make money work for him.

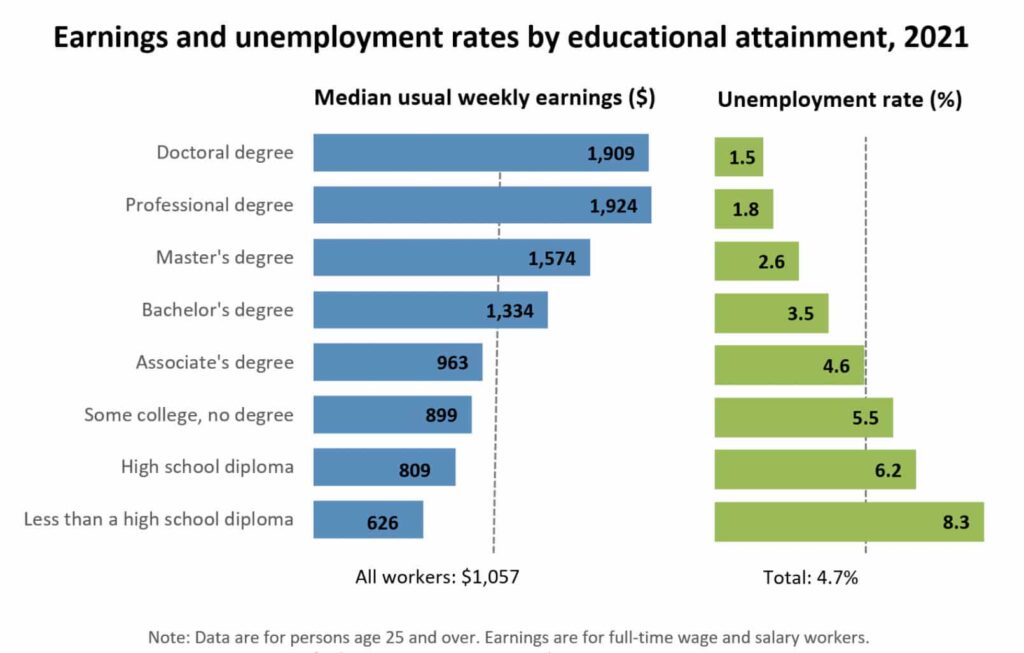

However, while the school system might be lacking in financial education, it is important to point out that almost every applicable study has shown that the more education you have, the higher your net worth and income. The Rich Dad, in this case, is undoubtedly an exception to the norm.

Let’s refer to the chart below:

So, on the whole, education does pay off when it comes to income. Your education level is unquestionably a significant factor in determining how much you earn. The data suggests that you’ll need at least some college education if you want a decent income.

Criticism of “Rich Dad Poor Dad”

One of Kiyosaki’s most ardent critics is John T. Reed, himself an author of self-published real estate investment books, who has devoted entire blog posts to point out (and unpack) every inaccuracy of Kiyosaki’s bestseller.

Although much of it reads like a petty personal vendetta against Kiyosaki (albeit entertaining), Reed is thorough and has done his homework. Unfortunately, Rich Dad Poor Dad does get some things wrong, including:

- He seems to advocate against diversification

Kiyosaki endorses what he calls “focusing” instead of diversification, saying: “Put a lot of your eggs in a few baskets and FOCUS: Follow One Course Until Successful.” However, diversification is commonly considered the most crucial aspect of a beginner’s investment portfolio. In fact, a recent study found that eight out of 10 millionaires invested in their company’s 401(k) plan.

- Insists on paying yourself first

While diverting a percentage of your income to your savings or investments (e.g., dollar-cost averaging) is a popular and accessible way of investing or starting out investing, Kiyosaki corrupts this concept by taking it into dangerous territory, suggesting his readers pay themselves prior to paying their bills and taxes.

His thinking is that this will pressure you into coming up with imaginative ideas to make money and cover those outstanding bills. Not only insulting to people living paycheck to paycheck, but this type of strategy can also have serious repercussions.

- He seems to endorse/be confused about insider trading

Kiyosaki suggests the reader have friends in the right places for providing non-public inside information on the stock market by saying:

“There are forms of insider trading that are illegal, and there are forms of insider trading that are legal. But either way, it’s insider trading. The only distinction is how far away from the inside are you? The reason you want to have rich friends who are close to the inside is because that is where the money is made. It’s made on information. You want to hear about the next boom, get in, and get out before the next bust. I’m not saying do it illegally, but the sooner you know, the better your chances are for profits with minimal risk. That is what friends are for. And that is financial intelligence.”

Robert Kiyosaki

To be clear, insider trading is illegal in the U.S. when the material information is still non-public.

Best Crypto Exchange for Intermediate Traders and Investors

-

Invest in cryptocurrencies and 3,000+ other assets including stocks and precious metals.

-

0% commission on stocks - buy in bulk or just a fraction from as little as $10. Other fees apply. For more information, visit etoro.com/trading/fees.

-

Copy top-performing traders in real time, automatically.

-

eToro USA is registered with FINRA for securities trading.

Robert Kiyosaki’s approach to investing summarized

Kiyosaki’s investing philosophy is simple. Namely, to become wealthy, you must build a portfolio of assets that generate passive income and minimize debt. In other words, he advocates for accumulating assets over material possessions and emphasizes financial knowledge through both theory and real-world experience. Moreover, he encourages entrepreneurship for alternative income streams. Naturally, this approach aligns with his belief in achieving financial independence through passive income and financial literacy.

In conclusion

To sum up, there are some great lessons about building wealth in Kiyosaki’s books, from stressing the importance of investing and financial education to tips on cultivating the right mindset for climbing the wealth ladder.

However, readers should be skeptical of some of the risky investment strategies Kiyosaki promotes (in Rich Dad Poor Dad), such as “paying yourself first,” i.e., investing before you pay the bills, or “putting a lot of your eggs in a few baskets,” i.e., opting for a low-diversified portfolio.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

FAQs about Robert Kiyosaki

Who is Rober Kiyosaki?

Robert Kiyosaki is an American entrepreneur, motivational speaker, and author who rose to fame after the mainstream success of Rich Dad Poor Dad. He built a brand around Rich Dad and now owns several financial education companies that provide people with personal finance and business education.

What is the Rich Dad philosophy?

The basic Rich Dad philosophy involves creating enough income from passive streams of investment income and growing them until they can fully support you without you having to work.

What is "Rich Dad Poor Dad" about?

Rich Dad Poor Dad is Kiyosaki’s story of growing up with two fathers— his biological father (the poor dad) and the father of his childhood best friend (the rich dad)— and how both men shaped his approach to money and investing. The book emphasizes the value of financial literacy, financial independence, and building wealth through income-generating assets, as well as not spending money you don’t have.

Is "Rich Dad Poor Dad" worth reading?

“Rich Dad Poor Dad” is considered worth reading by many for its insights on personal finance, investing, and wealth building. However, while some readers find its advice transformative, others critique it for its simplicity and lack of practical steps. Ultimately, its value depends on your financial knowledge and goals. It’s a popular starting point for those new to personal finance, but it’s advisable to complement it with other financial education resources for a more rounded understanding.

How much is Robert Kiyosaki worth?

Robert Kiyosaki’s net worth is approximately $100 million that he earned via publishing books and seminars about personal finance.

What books did Robert Kiyosaki write?

Robert Kiyosaki wrote a number of books. Some of his most widely read titles include:

- Rich Dad Poor Dad;

- Capitalist Manifesto;

- Rich Dad’s Increase Your Financial IQ: Get Smarter with Your Money;

- Rich Dad’s Guide to Investing: What the Rich Invest in, That the Poor and Middle Class Do Not!;

- Rich Dad Poor Dad for Teens.

Are there books like "Rich Dad Poor Dad"?

Books similar to “Rich Dad Poor Dad” include “Think and Grow Rich” by Napoleon Hill, offering timeless principles on success and personal development. “The Millionaire Next Door” by Thomas J. Stanley and William D. Danko provides insights into the habits of wealthy individuals. “The Richest Man in Babylon” by George S. Clason offers financial wisdom through parables set in ancient Babylon.

What are some famous Robert Kiyosaki quotes?

Robert Kiyosaki has several famous quotes that reflect his philosophy on wealth and financial education. One notable quote is, “It’s not how much money you make, but how much money you keep, how hard it works for you, and how many generations you keep it for,” highlighting the significance of saving, investing wisely, and creating generational wealth. Kiyosaki’s quotes often focus on the value of financial intelligence and the mindset difference between the rich and the poor.

What are Robert Kiyosaki's seminars about?

Robert Kiyosaki’s seminars, often based on his “Rich Dad Poor Dad” principles, focus on financial education, investing, real estate, and personal finance strategies. These seminars aim to teach individuals about wealth-building and financial independence. However, they have been subject to controversy, with criticisms over their marketing practices and the practicality of the advice offered.

Is Robert Kiyosaki a fraud?

Robert Kiyosaki has faced criticism and skepticism regarding his teachings and business practices. While some consider his advice on financial independence and investing valuable, others question the validity and practicality of his methods. There have been controversies surrounding his company’s bankruptcy and allegations of misleading seminar promotions.

Highly Rated Stock Trading & Investing Platform

-

Invest in stocks, ETFs, options and crypto

-

Copy top-performing crypto-traders in real time, automatically.

-

0% commission on buying stocks - buy in bulk or just a fraction from as little as $10. Other fees apply. For more information, visit etoro.com/trading/fees.

-

eToro USA is registered with FINRA for securities trading.