Since reaching its all-time high on June 18, Nvidia (NASDAQ: NVDA) stock has been trending downwards, erasing $1 trillion from its market cap and losing over 23% of its stock value.

The most recent trading sessions haven’t been much better, with NVDA stock closing the latest trading session at $103.73 after losing over 7%, adding to the losses of 12.86% over the previous five trading days.

However, pre-market trading shows signs of recovery for NVDA shares, with a progress of 5.08%.

Such poor performance and recent volatility have made investors wonder, will this semiconductor giant stock fall below a psychological threshold of $100?

Technical analysis of NVDA stock

Technical analysis of Nvidia stock reveals a recent breakdown through the support level at $118 triggered a negative signal, indicating the potential for further decline, possibly down to $103 or lower.

Currently, the stock trades between a support level of $95 and a resistance of $135.

In the short term, the stock’s performance is weakened by a negative volume balance, with the relative strength index (RSI) curve trending downward, which may indicate a potential downward trend reversal in the stock’s price.

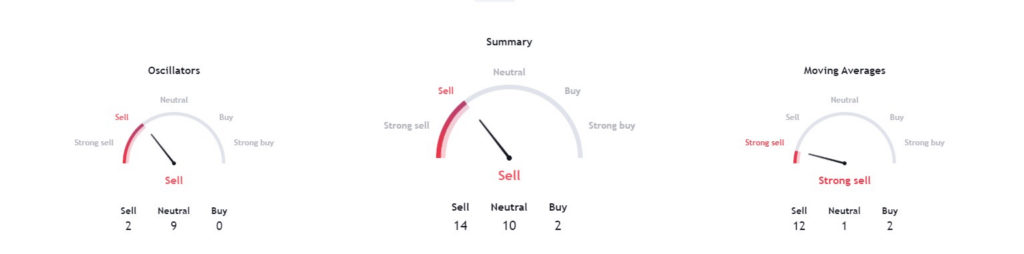

Further analysis of technical indicators reveals a “strong sell” signal, with all three gauges (oscillators, overall, and moving averages) tilting in the same direction–sell.

Continued stock sector rotation continues to hurt Nvidia’s stock

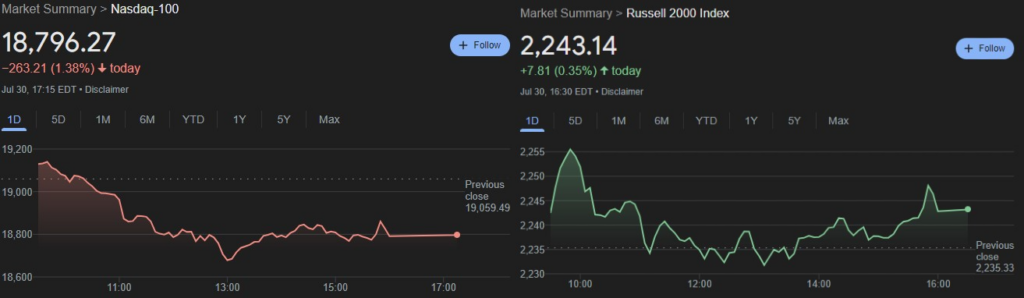

Nvidia shares dropped in the latest trading session as technology stocks faced broader challenges, with the Nasdaq-100 index declining by 1.38%.

An important metric to monitor during such drops is the Nasdaq’s performance relative to the Russell 2000.

When the Russell 2000 significantly outperforms the Nasdaq, it signals a ‘sector rotation,’ where investors shift away from large technology stocks into other areas, such as small caps or value stocks.

On July 30, the Russell 2000 gained 0.35%, outperforming the Nasdaq-100, which fell by 1.38% by a notable 1.73 percentage points, highlighting a significant divergence between the two major indexes.

Apple news caused a further decline in Nvidia stock

On July 30, Apple (NASDAQ: AAPL) released a comprehensive research paper detailing the creation of its large language models, which will be featured in the upcoming Apple Intelligence. Apple used TPU chips, designed by Broadcom (NASDAQ: AVGO) and commonly utilized in Google Cloud, for training its models.

At first glance, Apple’s decision to train its models without using Nvidia’s GPUs might seem concerning, given the company’s vast resources and growing artificial intelligence (AI) ambitions. However, it’s important to note that Apple’s computing power for this training is significantly less than what companies like Anthropic, OpenAI, xAI, or Meta Platforms (NASDAQ: META) use for their foundational models.

Nevertheless, with NVDA shares already under pressure, investors are on edge and quick to react. While the chipmaker giant might have brushed off news like this a month ago, the current market sentiment has made investors much more cautious, leading to a more pronounced impact on the stock.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.