Snowflake (NYSE: SNOW) has experienced fluctuations throughout 2024, resulting in a negative overall performance. Furthermore, technical indicators are now showing signs of pessimism towards SNOW stock.

Adding to the woes of a nearly 20% year-to-date price decline, SNOW shares have formed a Death Cross, marking the first downward-sloping 200-day moving average in their history.

A Death Cross in stocks happens when their short-term moving average falls below the long-term moving average. Typically considered a bearish signal, its impact is heightened by the downward trend of both moving averages in this case.

Picks for you

Could this Death Cross work out well for SNOW stock?

Although typically seen as a bearish indicator, Death Crosses have occasionally foreshadowed significant market rallies.

This is because crossing the 50- and 200-day simple moving averages often signals the market bottom, presenting a prime entry opportunity for investors.

Snowflake stock serves as a compelling example of this phenomenon. Following its previous Death Cross in August, SNOW embarked on a rally in the subsequent 90 days, boosting its valuation by over 50% from August 2023 to March 2024.

Within this rally, SNOW shares surged from a valuation of $170 to $284.

And now, after the formation of Death Cross, SNOW stock is up 3.59% in the premarket trading, potentially indicating a resurgence.

Other technical indicators aren’t keen on SNOW stock

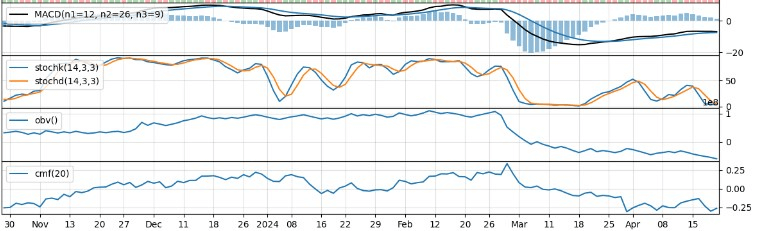

An analysis of technical indicators shows that SNOW stock is experiencing a downward trend, which is evident from both moving averages and the MACD indicator.

Declining RSI and Stochastic Oscillator readings indicate weakening momentum.

Additionally, decreasing volatility may herald a period of consolidation. Volume indicators paint a bearish picture, with selling pressure prevailing.

After analyzing technical indicators, SNOW’s outlook for the upcoming days appears bearish. The stock is expected to persist downward, possibly leading to more price drops.

Traders should be cautious and contemplate shorting or refraining from active trading until a distinct reversal pattern emerges.

The absence of buying interest and negative momentum and volume strengthens the bearish perspective on SNOW’s stock movement.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.