As artificial intelligence solidifies its influence over the S&P 500, prompting changes in its listing to incorporate more semiconductor-related stocks, some companies have entered the risky ‘overbought’ territory over the weekend.

When an asset is overvalued, it typically indicates a bearish outlook, suggesting a potential decline in the stock’s value. This anticipated decrease in price is expected as investors begin to sell off their positions.

Finbold analyzed specific stocks’ technical and fundamental indicators associated with this ranking to assess whether they were poised for a price decrease.

Nvidia (NASDAQ: NVDA)

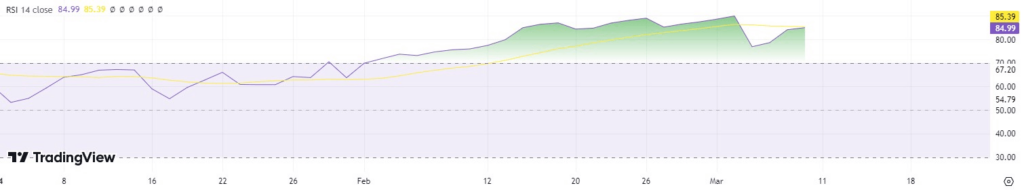

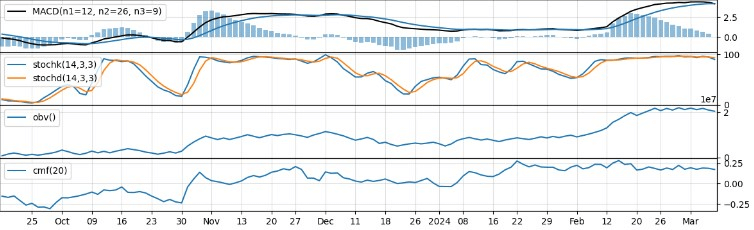

As the semiconductor giant Nvidia (NASDAQ: NVDA) stock continues its record-breaking performance, recent observations suggest its upward price momentum might be slowing down, signaling a potential price reversal as NVDA stock recently surpassed an RSI level of 90.

Recent market movements show that NVDA stock is experiencing increased volatility. Within just five hours, NVDA stock fluctuated from being down 6% to up 3% and then back down 2%.

Additionally, on March 9, NVDA stock saw its highest daily selling volume since August, 2023, contributing to the ongoing volatility trend.

General Electric (NYSE: GE)

General Electric (NYSE: GE) is undergoing a significant transformation. It is focusing on separating its energy and aerospace divisions through spin-offs.

The CEO is credited with orchestrating a successful turnaround and making strategic decisions. The company has shown strong performance, especially in its aerospace division, evidenced by rising orders and revenue.

However, opinions on the stock’s valuation vary. Some experts caution against its high price, while others point out the potential for future growth.

A high RSI may signal overbuying, particularly for larger stocks, which could result in a downward correction. An RSI of 84 GE stock is well in the ‘overbought’ territory.

Leidos Holdings (NYSE: LDOS)

Leidos Holdings (NYSE: LDOS) is a company specializing in defense, aviation, information technology, and biomedical research services. Headquartered in Virginia, it offers scientific, engineering, systems integration, and technical solutions. In August 2016, Leidos merged with Lockheed Martin’s (NYSE: LMT) IT sector, forming the largest IT services provider in the defense industry.

According to technical analysis, LDOS is poised for upward movement in the near future, backed by bullish trends and momentum indicators. However, decreasing volatility and mixed volume signals indicate a possible period of consolidation or sideways movement before further gains.

While these stocks are currently in the overbought zone, it’s important to factor in market volatility.

This volatility could either adversely impact their prices or potentially propel them into a more favorable volume trend. Monitoring market dynamics is crucial for assessing the future direction of these stocks.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.