Every year, as summer fades and September rolls in, the stock market seems to hit a rough patch. Known as the September Effect, this trend has quietly unnerved investors for over a century, making September the most dreaded month on Wall Street. But what’s really behind this? Let’s take a closer look at the factors that might be at play.

Highly Rated Stock Trading & Investing Platform

-

Invest in stocks, ETFs, options and crypto

-

Copy top-performing crypto-traders in real time, automatically.

-

0% commission on buying stocks - buy in bulk or just a fraction from as little as $10. Other fees apply. For more information, visit etoro.com/trading/fees.

-

eToro USA is registered with FINRA for securities trading.

What is the September Effect?

Despite being labeled an anomaly, the September Effect challenges the Efficient Market Hypothesis (EMH), which posits that stock prices reflect all available information and thus should not follow predictable patterns based on the calendar.

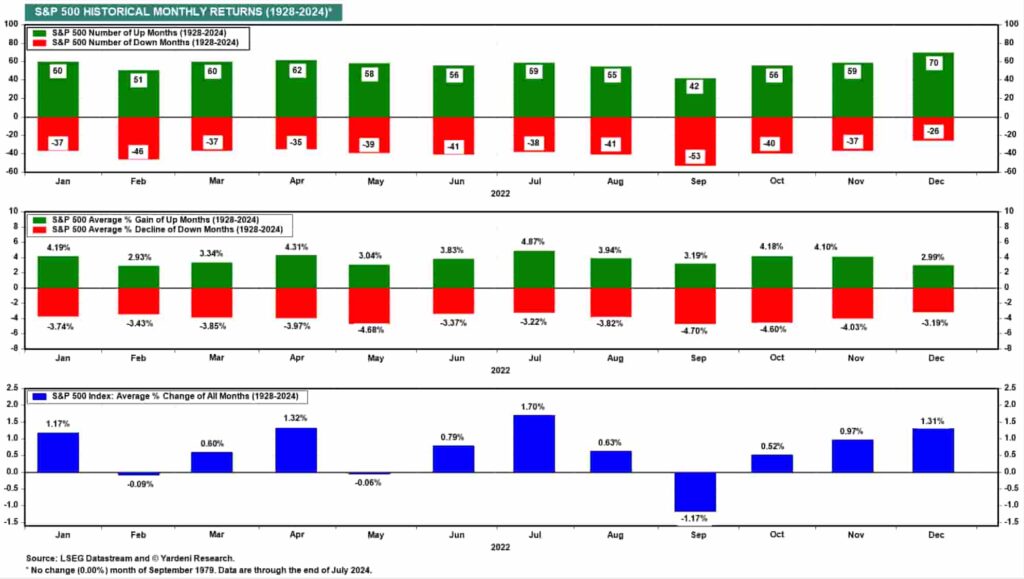

September has consistently been the worst-performing month for major stock indices, including the DJIA, S&P 500, NASDAQ, Russell 1000, and Russell 2000, particularly since 1950. Indeed, the month has been marked by significant downturns, especially during critical periods such as the dot-com bubble and the height of the subprime crisis in 2008.

Plus, the data shows that from 1928 through 2024, September has been the most frequently negative month for stocks, with the S&P 500 index declining more often during this month than any other.

It’s important to note that while September’s reputation as a tough month for stocks is well-documented, it doesn’t guarantee a decline every year. The September Effect is an average trend observed over a long period, meaning that in some years, the market may perform well in September.

September Effect vs October Effect

5 factors contributing to the September Effect

Several theories attempt to explain why September has historically been the worst month for stock market performance. While no single cause has been definitively proven, the following 5 factors are commonly cited as contributing to the September Effect and causing a concentrated downturn:

- Summer holidays: During the summer months, particularly from June to August, trading volumes typically decrease as many traders and investors go on summer vacation. This reduced activity can result in lower market volatility and fewer reactions to negative news. When investors finally return in September, they often rebalance their portfolios, selling off underperforming assets;

- Delayed reaction to bad news: Over the summer, with fewer eyes on the market, bad news may not immediately impact stock prices. However, when traders return in September, the market begins to react to this accumulated bad news, leading to a potential sell-off. Research has shown that stock prices generally respond more slowly to negative news, especially during periods of low trading activity, like the summer;

- Institutional portfolio rebalancing: Many mutual funds and institutional investors close their fiscal year in September. To optimize their portfolios, these institutions often sell off losing positions before the end of the quarter, which can add downward pressure to the market. This behavior is similar to year-end tax-loss harvesting but occurs earlier in the year;

- Bond market dynamics: September often sees a spike in bond issuances as companies and governments seek to raise capital after the summer lull. Higher interest rates during this time can make bonds more attractive, pulling capital away from equities and contributing to stock market declines. The shift of investment from stocks to bonds during September can reduce liquidity in the stock market;

- Market psychology: The September Effect may also be a self-fulfilling prophecy. Traders and investors, aware of the historical trend, might anticipate a decline and adjust their strategies accordingly, which can exacerbate the sell-off. Seasonal behavioral biases, such as the need to fund educational expenses or prepare for end-of-year expenditures, may also prompt individual investors to sell stocks in September.

Highly Rated Stock Trading & Investing Platform

-

Invest in stocks, ETFs, options and crypto

-

Copy top-performing crypto-traders in real time, automatically.

-

0% commission on buying stocks - buy in bulk or just a fraction from as little as $10. Other fees apply. For more information, visit etoro.com/trading/fees.

-

eToro USA is registered with FINRA for securities trading.

Tips and tricks for investors during September

To stay ahead of September’s notorious market volatility, here are essential strategies to help you navigate this challenging month effectively:

- Monitor economic indicators: Keep an eye on key data like employment reports and Federal Reserve statements;

- Watch earnings reports: September often coincides with third-quarter earnings, so use these to gauge market health;

- Pre-September adjustments: Consider rebalancing in late August to lock in gains and reduce risk;

- Diversify: Spread your investments across asset classes to cushion against potential downturns;

- Focus on defensive stocks: Consider sectors like consumer staples, healthcare, and utilities, which tend to be more resilient, or invest in companies with a strong history of paying dividends for added stability;

- Avoid high-volatility stocks: Stick to well-established companies with solid fundamentals.

- Use dollar-cost averaging: Spread out investments over time to reduce the impact of short-term fluctuations.

- Don’t panic-sell: Avoid making emotional decisions based on short-term market movements;

- Review goals: Ensure your investment strategy aligns with your long-term financial objectives;

- Liquidity: Having cash allows you to seize buying opportunities during market dips;

- Avoid over-leveraging: Keep debt low to mitigate potential losses;

- Stay updated: Keep an eye on international markets and geopolitical developments that could impact U.S. stocks.

The bottom line

September’s reputation as a rough month for the stock market isn’t just superstition—it’s backed by decades of data. And while the reasons behind the September Effect are still debated, the trend is real enough to keep in mind. As a result – whether driven by market psychology or deeper economic factors – recognizing this pattern can help investors make more informed decisions during this tricky time of year.

Highly Rated Stock Trading & Investing Platform

-

Invest in stocks, ETFs, options and crypto

-

Copy top-performing crypto-traders in real time, automatically.

-

0% commission on buying stocks - buy in bulk or just a fraction from as little as $10. Other fees apply. For more information, visit etoro.com/trading/fees.

-

eToro USA is registered with FINRA for securities trading.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

FAQs about the September Effect

What is the stock market September Effect?

The September Effect is a historically observed phenomenon where stock markets tend to underperform during September. This trend, particularly noted in indices like the S&P 500, DJIA, and NASDAQ, has led to September being recognized as the worst month for stock market performance on average.

Why do stocks go down in September?

Stocks go down in September due to a combination of factors: traders returning from summer vacations often rebalance their portfolios, which can lead to increased selling pressure; mutual funds may also close their fiscal years, prompting the sale of losing positions; and historically lower trading volumes during summer can result in delayed reactions to bad news, which then impacts the market more heavily in September.

What month do stocks go up the most?

Historically, December is often the best-performing month for stocks, largely due to the “Santa Claus Rally,” where stock prices rise in the last week of December and into the new year, driven by factors like holiday optimism, year-end bonuses being invested, and the general lack of tax-loss harvesting after the fiscal year-end.

Why is August and September the worst month for stocks?

Due to several factors, August and September are often the worst months for stocks. In August, trading volumes typically decrease as many traders and investors take vacations, leading to lower market liquidity and higher volatility. This can set the stage for September, where the market often sees increased selling pressure as investors return, rebalance their portfolios, and mutual funds close their fiscal years. Additionally, delayed reactions to negative news accumulated over the summer can trigger further declines in September.

Is September a good month for stocks?

Historically, September is not a good month for stocks. It has consistently been the worst-performing month for key indices like the S&P 500, DJIA, and NASDAQ. Indeed, on average, stocks decline more frequently in September than in any other month.

Why is the stock market volatile in September?

The stock market is volatile in September due to several factors, such as portfolio rebalancing after the summer, increased selling pressure from mutual funds closing their fiscal years, and a return to average trading volumes after the summer holidays. Lingering economic concerns and geopolitical events can exacerbate this volatility, leading to more pronounced market swings.