Despite its reputation for being a risky and complex endeavor, investing in the stock market is, in fact, among the most potent avenues for building wealth over the long term, even for individuals starting with a modest initial investment. This guide will provide you with a step-by-step approach on how invest in stocks in the UK, the pros and cons of investing in stocks, practical tips for successful investing, as well as suggestions on the best brokers to use.

Highly Rated Stock Trading & Investing Platform

-

Invest in stocks, ETFs, options and crypto

-

Copy top-performing crypto-traders in real time, automatically.

-

0% commission on buying stocks - buy in bulk or just a fraction from as little as $10. Other fees apply. For more information, visit etoro.com/trading/fees.

-

eToro USA is registered with FINRA for securities trading.

How to start investing in stocks in the UK?

So how exactly do you start investing in stocks in the UK? It’s more straightforward than you might think, and you have a few options to do so. One of the most hassle-free methods is opening an online brokerage account to purchase individual stocks or stock funds.

If you find that intimidating, there’s always the option of enlisting the help of a professional to handle your portfolio. Regardless of your chosen route, investing in the stock market online is accessible and doesn’t require a massive initial investment.

How to buy stocks in the UK: step-by-step

The process of buying stock online is relatively straightforward and fast. Here’s a comprehensive step-by-step manual to kick-start your journey in equity investment.

Step 1: Select a broker

To buy stocks in the UK, you need a brokerage account. While countless platforms are available, the one that suits you will depend on your investment style (long-term buy-and-hold strategy or active day trading) and needs (e.g., whether you want to trade more advanced financial products such as options). When evaluating brokers, consider the following characteristics:

- Fees: Brokerage fees are charges levied by brokers to execute your transactions or provide specialized services. Fortunately, most online brokers nowadays offer commission-free stock exchange-traded funds (ETF) trading;

- Security: Choose a reliable broker fully regulated by the Financial Conduct Authority (FCA);

- Trading tools: Active traders might prefer brokerage accounts with advanced features. Some brokers provide fully customizable platforms with comprehensive analysis tools or access to additional data for an extra cost. Avoid paying extra for unnecessary additions. If you’re new to stock trading, a user-friendly platform with a competitive fee structure is advisable. A dedicated section with investing tips and tricks is also a bonus;

- Access to market data: Opt for a platform that provides access to robust market research and reporting tools to help you trade confidently with updated data;

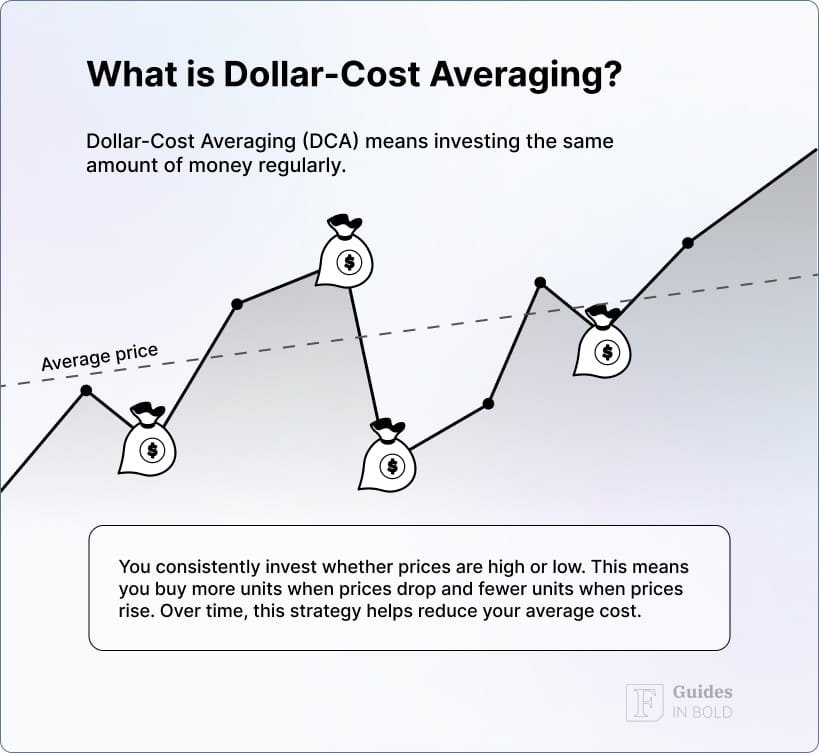

- Fractional stock trading: Fractional shares enable investors to buy stock or ETFs based on the cash amount rather than the number of shares. This is particularly useful for investors with limited capital who want to build a diversified portfolio or set up a dollar-cost averaging strategy.

Where to buy stocks in the UK?

The stock market has become more accessible and affordable than ever, thanks to various online brokers. However, choosing the right broker that meets your needs (investment goals, educational tools, trading style) is crucial for a seamless trading experience.

To securely buy stocks in the UK, consider eToro, which offers:

- Commission-free stock trading;

- 2,000+ stocks from 17 exchanges;

- Fractional shares available;

- User-friendly platform.

Highly Rated Stock Trading & Investing Platform

-

Invest in stocks, ETFs, options and crypto

-

Copy top-performing crypto-traders in real time, automatically.

-

0% commission on buying stocks - buy in bulk or just a fraction from as little as $10. Other fees apply. For more information, visit etoro.com/trading/fees.

-

eToro USA is registered with FINRA for securities trading.

Step 2: Decide on the stocks to buy

Without delving too much into the various methods of analyzing and selecting individual stocks, here are some tips for best practices:

- Company research: Stock analysis is paramount to understanding a company’s financial strength. Start your research by reviewing the company’s public filings with the SEC. The EDGAR database provides free access to corporate information, letting you research a public company’s fundamentals. After assessing the potential risks and rewards, decide whether you want that particular stock in your investment portfolio;

- Think long-term: Invest in stocks with the intention of holding them for an extended period. Refrain from acquiring a stock solely based on its projected short-term performance;

- Don’t put all your eggs in one basket: Avoid putting all your capital into just one or two stocks. Instead, even if you’re starting with a relatively small investment, spread your risk by buying a few shares of several different companies. Plus, thanks to the emergence of commission-free trading, owning shares of multiple companies does not incur any additional cost.

Consider investing in ETFs

Step 3: Decide your investment amount

Now that you’ve decided on a stock, you’ll need to determine how much you want to invest.

Your investment depends on the stock price and the number of shares you want to acquire. If the share price of a company you’re interested in is financially unattainable, you can consider fractional shares. Fractional shares let you buy shares based on the cash amount you’re comfortable with, so you may end up with less than, equal to, or more than a whole share.

Since investing can yield unpredictable returns, it’s vital you invest only what you can afford to lose.

Funding your account

Step 4: Execute your order

After determining the cash amount or the number of shares you want to buy, you can place your order. This is done by logging into your account and inputting the ticker symbol of your desired stock into the search bar. Your order will generally be completed in a matter of seconds, assuming it’s a market order, after which your portfolio will be updated to display the new shares you’ve just purchased.

There are various execution options available, including:

- Market order: A market order is an instruction to purchase the stock at the current market price, which is generally executed immediately (subject to availability);

- Limit order: A limit order is activated once the stock hits your designated price. For instance, suppose you wish to purchase stock X at £50 or less. You would set the limit price at £50, and the order would execute only when the stock hits the set price or falls below it;

- Options contract: Options speculation allows for leveraged positions in a security at a fraction of the cost of the underlying asset. A call option enables the trader to profit if the stock price goes up, while a put option allows them to profit if the stock price goes down. Remember, derivative instruments can only be traded on a margin account, which usually requires a higher minimum balance than regular brokerage accounts.

Step 5: Develop your portfolio

The last step in this journey is nurturing your investment portfolio. Now that you’ve set up a brokerage account and learned the basics of trading stocks, you can keep augmenting your account and investing in stocks you’d like to hold for the foreseeable future.

While it may be enticing to check the performance of your stocks daily (especially in the beginning), it’s vital to have a long-term perspective. Of course, you should review quarterly reports and subscribe to stock news alerts to keep up-to-date with the companies in which you own stock. However, if your stocks’ prices dip slightly, avoid panic selling. Similarly, resist the temptation to cash out immediately if your stocks’ prices increase slightly.

Ultimately, the most effective and simplest method for wealth accumulation over time involves investing in high-quality, or blue-chip, companies and holding onto their shares as long as they continue to perform well.

Next, we’ll delve deeper into what stocks to choose for your investment portfolio.

Best UK stocks to invest in

What UK stocks to invest in largely depends on your personal investment goals, risk tolerance, and investment horizon. With that said, here are some sectors and types of companies you might want to consider:

- Blue-chip stocks: Large, well-established, and financially sound companies with a history of reliable performance. In the UK, this often refers to companies in the FTSE 100 Index, such as Unilever (LSE: ULVR), Shell (LSE: SHEL), AstraZeneca (LSE: AZN), HSBC (LSE: HSBA), and BP (LSE: BP);

- Dividend Stocks: Dividend stocks are companies that distribute a portion of their profits to shareholders, generally quarterly. Similar to the aforementioned blue-chip stocks, these companies are often well-grounded in their industries, providing an excellent avenue for generating passive income;

- Real estate investment trusts (REITs): REITs are another fantastic option for investors seeking passive income. These investment trusts own, oversee, or finance properties that generate revenue and are traded on the London Stock Exchange (LSE), making them easily accessible and highly liquid. REITs typically secure tenants through long-term leases, resulting in dependable income streams. A significant portion of this income is distributed to investors as dividend payments. In fact, REITs must disburse at least 90% of their annual profits to shareholders through dividends. Some REITs that can be bought through the LSE include Ediston Property Investment Company (LSE: EPIC), The PRS REIT (LSE: PRSR), and Assura (LSE: AGR);

- Growth stocks: Companies expected to grow at an above-average rate compared to other businesses in their industry or the market as a whole, often tech or innovation-driven. During periods of economic growth, growth stocks typically thrive, and these stocks enjoyed a favorable trading environment in the decade leading up to 2024. Subsequently, however, a detrimental economic mix of surging inflation, increasing interest rates, and the cost-of-living crisis have contributed to a recessionary forecast, dampening the growth sector’s momentum;

- Value stocks: Value stocks are companies that, according to investors, are underpriced in relation to the underlying business’s intrinsic value;

- Renewable energy stocks: With an increasing focus on sustainability and clean energy, companies in this sector could offer exciting investment opportunities;

- ETFs: If picking individual stocks isn’t for you, consider investing in ETFs that track a certain index, sector, or theme. For example, you might invest in an ETF that follows the FTSE 100 to gain broad exposure to the UK market. The FTSE 100 index is tracked by several ETFs, such as the iShares Core FTSE 100 UCITS ETF (LSE: ISF) and Vanguard FTSE 100 UCITS ETF (LSE: VUKE).

Trading US stocks in the UK

Most brokers enable you to trade US stocks using the same account you’d typically use for UK shares. The process of doing so is almost identical, with stocks commonly recognized by their ticker symbols, like TSLA for Tesla and DIS for Disney. However, it’s worth noting that a brokerage might not offer every stock listed on the US exchanges, as they usually focus on stocks most sought-after by investors.

When trading US stocks, two main fees need to be taken into account:

- Commissions: Fee for executing your trade. Luckily, there are plenty of commission-free providers, such as eToro;

- Foreign Exchange (FX) Fees: The cost levied by the provider for converting your currency to US dollars.

If you’re purchasing US shares from the UK, your broker will likely request you to fill out a US tax form known as W-8BEN. The W-8BEN form is a one-page document requiring some basic personal information. Once filled out, it results in a reduced tax of 15% being deducted from dividends paid on US stocks, as opposed to the standard 30% rate.

Remember to diversify

Mistakes to avoid when investing in stocks in the UK

Mistakes are par for the course when it comes to stock investing but can be avoided if you know what to look out for. For an in-depth discussion, refer to our comprehensive guide on the 17 common investing mistakes, complete with advice on how to steer clear of them.

For now, however, let’s briefly touch on a few of the usual suspects:

- Neglecting to thoroughly research the stock;

- Operating without clear-cut financial objectives;

- Attempting to time the market;

- Overlooking the importance of portfolio diversification;

- Succumbing to emotional decision-making in your investments.

Pros and cons of investing in stocks in the UK

To help you decide whether stocks are a wise investment for you, let’s take a look at the key pros and cons of investing in stocks in the UK. It’s worth noting that these pros and cons are not exhaustive, and there may be other factors to consider when deciding whether or not to invest in stocks.

Additionally, the risks and benefits of stock investing may vary depending on individual circumstances and investment goals.

Pros

- Potential for high returns: Over the long term, stocks have historically yielded higher returns than more conservative instruments such as bonds and savings accounts;

- Liquidity: Stocks are generally liquid, meaning they can be bought or sold any day the market is open, making it easy for investors to access their money if needed;

- Ownership stake: Buying a company’s stock means buying a piece of that company. Shareholders often have the right to vote on corporate matters and may receive dividends, which are portions of the company’s profits distributed to shareholders;

- Diversification: Stocks offer the opportunity to diversify an investment portfolio. For example, by investing in companies in different sectors, geographical locations, and market caps, investors can reduce their risk;

- Hedge against inflation: Despite occasional downturns in the stock market, it has consistently demonstrated a historical trend of returns that surpass inflation. For example, the average annual return from the S&P 500 for the past 50 years has been approximately 10.38%.

Cons

- Market risk: Stocks can be volatile and subject to sudden price fluctuations based on various factors, including economic indicators, political events, and company-specific news. This can lead to potential losses for investors;

- Time-consuming: Successful stock investing generally requires a deep understanding of the market, individual companies, and financial concepts, demanding significant time investment towards research as well as portfolio management and rebalancing;

- No guaranteed returns: Unlike bonds or certificates of deposit, stocks do not offer guaranteed returns. It’s possible to lose all the money you invest in stocks;

- Psychological factors: The ups and downs of the stock market can lead to emotional investing, such as panic selling or exuberant buying, resulting in poor investment decisions;

- Potential for fraud: While regulatory bodies work hard to prevent fraud, it can still occur in the stock market. Investors need to be wary of too-good-to-be-true investment opportunities.

In conclusion

It’s essential to remember that while investing in the stock market can present an opportunity for significant financial gains, it’s not without its risks. Ultimately, the stock market is not a shortcut to instant wealth but rather a means for fostering long-term economic growth.

The key to successful investing, therefore, lies in understanding the market’s inner workings, diversifying your portfolio, and maintaining a patient and disciplined approach, as emotional reactions to market volatility often lead to poor decisions.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

FAQs about how to invest in stocks in the UK

How to invest in stocks in the UK for beginners?

To begin investing in stocks in the UK, open an account with a reputable online brokerage and start by purchasing shares of individual companies or investing in ETFs. Monitor your investments regularly and adjust your portfolio as needed.

How to buy stocks in the UK?

To buy stocks in the UK, you first need to open an account with a licensed online brokerage. Once your account is set up, you can select and purchase stocks through the brokerage’s platform.

Where to buy stocks in the UK?

In the UK, you can buy stocks through licensed online brokerages such as eToro. Always ensure the platform you choose is regulated by the FCA.

How to invest in dividend stocks in the UK?

To invest in dividend stocks in the UK, first, open an account with a regulated online brokerage. Then, research and select companies known for regular dividend payouts. Purchase shares of these companies through your brokerage account. Remember to reinvest the dividends for compounded growth over time.

How to invest in US stocks from the UK?

To invest in US stocks from the UK, you’ll need to open an account with a brokerage that offers access to international markets, including the US. Once your account is active, you can purchase shares of US companies or US-based ETFs.

Highly Rated Stock Trading & Investing Platform

-

Invest in stocks, ETFs, options and crypto

-

Copy top-performing crypto-traders in real time, automatically.

-

0% commission on buying stocks - buy in bulk or just a fraction from as little as $10. Other fees apply. For more information, visit etoro.com/trading/fees.

-

eToro USA is registered with FINRA for securities trading.